‘It was really the credit crunch that was our making’: Piers Williamson on two decades at THFC

After 22 years at the helm of sector bond aggregator The Housing Finance Corporation, Piers Williamson sits down with Sarah Williams to talk through two decades of turnaround, transactions and traversing market turbulence

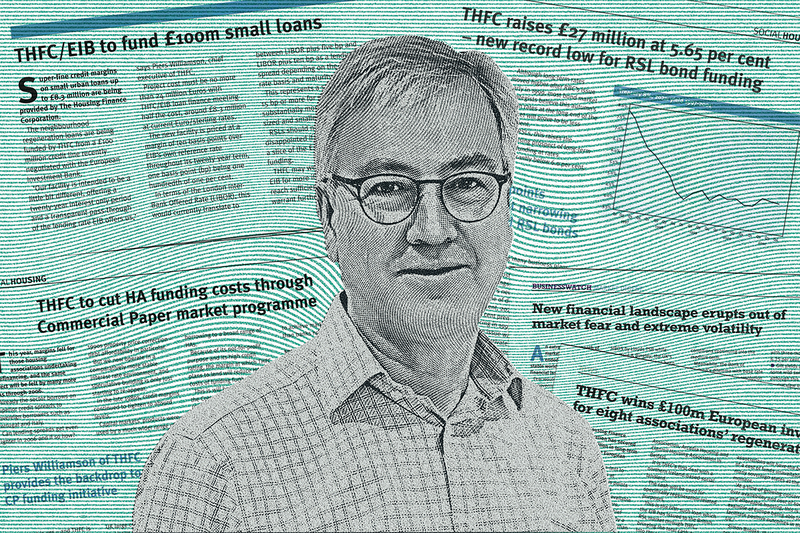

“There’s this horrible photo of me outside of the Guildhall,” Piers Williamson tells Social Housing, reaching his mind back to 2002 and an interview he gave to a trade magazine in his first week as chief executive of The Housing Finance Corporation (THFC).

“And I was thinking, why on earth am I being given an interview? I’ve done nothing in this sector.”

As Social Housing comments across the table to Mr Williamson in our own interview, more than 22 years later and with almost £6.5bn of additional funding on THFC’s books, that has certainly changed.

If 2002 marked Mr Williamson’s first sector interview, our own meeting earlier this year is something closer to an exit interview, as the veteran funding boss looked set to step away from the helm of the organisation.

While Mr Williamson will not officially leave the aggregator until August, his plan at the time of our conversation, shortly before his successor Priya Nair joined the company, was very much to “go into the undergrowth” soon after her arrival.

Ms Nair, who was previously senior director of infrastructure at Abrdn Investment Management, joined on 11 March and the transition will formally complete at the company’s AGM later this month.

“Most people only get to resign as a chief executive once, I suppose,” Mr Williamson says. “Everyone that I’ve talked to says ‘get out of there as quickly as possible’. Because, although we’ve worked through this pretty hard with all the staff, it’s a shock to everyone having a new boss, and they just need to kind of get over it. That’s the tough love bit.”

It is a process that colleagues at the bond aggregator have had to get used to in recent years, as the trio at the helm of the organisation for more than two decades have departed, each in turn.

Most recently before Mr Williamson, Fenella Edge retired in January after 21 years as group treasurer. Before that, it was Colin Burke, the organisation’s former finance director and company secretary, who retired in June 2022, also after 21 years.

Turnaround

Back in the early days of this leadership trio, THFC was in need of some tough love of its own.

“It was a turnaround business when we came into it,” Mr Williamson recalls. “Probably the first two years, the three of us were going ‘what on earth have we done?’ in joining.”

Founded in 1987 through a partnership between the National Housing Federation and what was then the Housing Corporation (the predecessor to Homes England and the Regulator of Social Housing), THFC was set up to provide housing associations with long-term capital markets funding. A year later, the passing of the Housing Act made it possible for housing associations to access private finance, putting into practice the ‘mixed funding model’ of grant plus debt to support delivery.

Some positive developments for the company followed in its next decade, including bringing in European Investment Bank (EIB) funding in 1998. However, by the time the new leadership arrived in the early noughties, the funder’s core product had – in the words of Ms Edge in a recent interview – “fallen out of favour”.

Indeed, in Mr Williamson’s first few years leading the aggregator, it was not unusual for the chief executive to be met with a greeting along the lines of “oh, you’re the lot that are responsible for those expensive loans”, he says.

In time, the funder would more than address this – not least as the chosen provider of the first government-backed guarantee scheme for affordable homes, in 2013. This would see THFC lend more than £3.2bn over three years, often at a cost of debt below two per cent.

But before it could reach these heights (or rather lows, where pricing is concerned), the company that Mr Williamson inherited as the millennium got under way was in need of a shake-up.

This, he recalls, included the need to iron out some governance issues to ensure the board and executive were aligned on the organisation’s future.

In pursuit of that future, it also needed to get the right financial apparatus in place.

Modern approach to the markets

In 2004, the company obtained its own credit rating for the first time, as it looked to make the most of the debt capital markets with a new bond structure and a more modern approach.

Previously, THFC’s issuance had been through a variety of conventional and index-linked debenture stock, all publicly listed on the London Stock Exchange, but the funder wanted to issue own-name Eurobonds. To do so, it was prepared to ask ratings agency S&P Global to rate existing debt instruments that it had already started to repay, even though investors – operating within rather different financial regulatory parameters to the ones today – had been willing to buy them unrated.

At the time, most housing associations were “not at all” comfortable with the capital markets, Mr Williamson says. Apart from THFC’s own issuance, the first of which was in 1987, only a handful of other bonds had been seen in the sector in the decade and a half since the Housing Act, including issuance by both Home Group and Places for People (North British Housing).

THFC was given an A+ long-term rating from S&P (today at A, alongside an A2 from Moody’s on its Blend subsidiary), and this paved the way towards re-entering the debt capital markets on current market terms – and an opportunity to improve the cost of funding within its existing loan book.

Mr Williamson reflects on the journey. “I think we took this place from being what was viewed by a lot of people as an ‘irrelevance’, to a relevance.”

He adds: “Any business that has written long-term loans: you live by the sword, you die by the sword. So a lot of the loans that THFC wrote when it was founded in the late ’80s, early ’90s were very high-coupon.

“That was the going rate for loans and it was perfectly logical; [housing associations] were getting 90 to 95 per cent grant rates back then. So you could afford to pay 12 per cent on a teeny-weeny bit of debt. But the thing is, the teeny-weeny bit of debt sticks around for 30 years, and it has a 10 to 12 per cent coupon on it.

“And what we’ve done collectively, the whole team, is rewrite that book from £1.5bn of quite expensive debt to £8bn of what will probably be the cheapest debt on those housing associations’ balance sheets for a long time.”

Part of the journey was what Mr Williamson refers to as the aggregator “eating its own tail” where older loans on its books were concerned, using its newly gained credit rating.

“We were treasury experts, and we could see that there were particular windows in the market where you could refinance the deals that we’d done [around] 15 years before, and create a positive net present value, and so an economic gain for our clients for doing that. But you had to spot periods in the market where, basically, credit spreads had moved to a particular level.”

The first of these transactions, through the THFC Funding No 1 vehicle set up in 2004, took place in 2006.

“We refinanced probably five or six borrowers, their historic debt instruments, and rolled them into a new debt instrument that gave them basically a cash flow gain. We did a little bit of new lending on top of that, but not very much, so we were occupying this niche that said ‘we can show you how you can make economic gain from refinancing stuff’.

“And I suppose we’d started the engines a little bit, and there were only seven or eight people that were working for THFC then, and we proved that we were viable as a business.”

Then came 2007, and the ensuing financial crisis.

Financial crisis takes hold

“It was really the credit crunch that was our making,” Mr Williamson says.

“Over the 37 years we have been in business, we have proved that THFC is counter-cyclical. So when there are big financial failures, we have grown rapidly.”

As far as macroeconomic incidents go, there have been many in Mr Williamson’s time at THFC. These have included the impact of Brexit following the 2016 referendum, and the global shock of the pandemic from early 2020 (“That was a human crisis; it wasn’t a financial crisis,” he notes). In more recent history, market impacts have arisen from Russia’s invasion of Ukraine in February 2022 and the now infamous ‘Trussonomics’ Mini Budget in September the same year (“Some of the intra-day volatility in gilts was absurd; it was more volatile than 2007,” Mr Williamson recalls).

But it is the financial crisis of 2007-08 that the veteran chief executive sees as the standout incident in his time at the company’s helm.

“2007 was the biggest,” Mr Williamson says. “It just kept coming, it just kept getting magnified, and it went from ‘which banks are going bust this week?’ to ‘which countries are going bust this week?’. And at the time, no one had ever experienced anything like that.”

On Monday 15 September 2008, global financial services firm Lehman Brothers filed for bankruptcy after a final attempt at a rescue over the preceding days had failed.

Mr Williamson – whose ‘extracurricular activities’ famously include playing bass in numerous bands – recalls observing how events were unfolding in the markets.

“I remember that weekend that Lehman’s went bust, I was at a band practice with our drummer, and our drummer was a bond trader.

“We were both driving back going ‘what on earth is going to happen tomorrow?’ And we really, really didn’t have a clue. It was a proper, proper meltdown.”

For THFC, however, the crisis soon became a time to shine.

Long-term bank debt – on which a healthy supply of banks had previously competed to woo associations – was drying up amid a liquidity crunch. The aggregator was ready to spring into action to ensure associations did not lose access to funding.

With the right structures now in place internally and a credit rating in tow, THFC could, as Mr Williamson puts it, “get [its] money from a different pot – the only other pot there is in the city”.

“The terms of trade changed, remarkably, and the markets were open to us,” he says. “And really, we didn’t look back.”

The company’s ability to access the debt capital markets and raise money through bond issuance to on-lend to its borrowers saw the funder come into its own.

Annuity funds and “proper old-fashioned life insurance companies” wanted to lend very long term to “very boring, stable businesses that would deliver people nice, safe returns on their pensions”, Mr Williamson says. “We represented that.”

At the same time, a steep rise in the cost of credit across the board meant that buying bonds became an attractive proposition for this type of investor. Housing associations, meanwhile, were turning to THFC for help.

Growth and guarantees

The rebalancing towards the capital markets was not instant, with some bank lending continuing where credit approvals were already in place, but from around 2010-11, THFC “really started growing”, Mr Williamson says.

Notable achievements followed for the company, including being selected in 2013 to run the first government-backed guarantee scheme for affordable homes, after around four years of conversations with the government about the potential for such a scheme.

As new supply via house builders evaporated in the wake of the financial crisis, first Labour and then the coalition government of Conservatives and Liberal Democrats were looking to provide some of the fuel needed to stimulate delivery.

In 2012, government announced £10bn of guarantees across affordable homes and private rented sector schemes, with an initial £3.5bn pot made available for each sector.

Through a special subsidiary set up for this purpose, Affordable Housing Finance Plc, THFC would lend £3.24bn over three years to 59 housing associations. Delivering a cost of funds regularly below two per cent, the aggregator was now a far cry from its “expensive loans” of yore.

Eyes on the EIB

Another key part of the process to bring down the cost of lending at THFC – and a core part of the capital that went into its guarantee scheme – was nurturing the company’s relationship with the lending arm of the European Union. As Mr Williamson puts it: “EIB money is just the cheapest you’ll ever find in the sector.”

In 2001, THFC had somewhere in the region of £50m in investments from the EIB, dating back to 1998. These had resulted from successful negotiations by Mr Williamson’s predecessors, who had highlighted the company’s ability to direct funding towards regeneration at scale, with green and social outcomes.

But taking that EIB total to where it is today, at £2.5bn, relied on THFC being able to better define its function, to unlock larger amounts of funding. This was helped by THFC’s new credit rating, Mr Williamson says.

“We were able to say ‘yes, we’re not a bank, we’re unregulated, but actually we’re at a single A+ credit rating – what’s not to like about that?’ And they bought that story, and started giving us, typically, £100m lines [of credit]. And we were getting that out to housing associations to do proper regeneration.”

The success of this relationship in its heyday means that, despite the taps inevitably being turned off after Brexit, the body of funding received from the EIB remains significant at a European level. “We’re still the largest conduit for European housing regeneration money anywhere,” Mr Williamson says. “They lent us £2.5bn – and still do.”

Nonetheless, the end of the affair – triggered by the 2016 referendum and sealed with the UK’s formal exit from the European Union on 31 January 2020 – cannot have been easy, Social Housing suggests.

“We were kind of prepared in some ways,” Mr Williamson says. “We had already squirrelled away £1bn worth of capacity in the guarantee programme through EIB. And we had made damn sure there wasn’t any wording in the contract that said that, if the UK left the European Union, that was a problem.”

He adds: “Clearly, as a longer-term thing [it would be], but we had squirrelled away as much capacity as we possibly could.”

Indeed, despite a recognition on both sides that Brexit would put paid to lending, Mr Williamson remains optimistic about future partnerships. “In terms of the choices of EIB in the future, I still maintain a hope that if we’re ever going to do anything, and if relationships thaw with Europe, it’s the green economy that we might actually make some progress on.

“Clearly, we’ve got the UK Infrastructure Bank now, but the UK is only an AA credit. And EIB has got every AAA rating you could ever want.”

Disappointment to opportunity

Not long after its inevitable break-up with the EIB, THFC faced the commercial heartbreak of missing out on the position of delivery partner for the second iteration of the Affordable Homes Guarantee Scheme (AHGS). The AHGS 2020 was to have a £3bn pot of guarantees (essentially the balance of the original £10bn of guarantees announced in 2012), and potential for a further top-up to £6bn, which has now happened.

In June 2020, Social Housing revealed that ARA Venn – the government’s delivery partner on the 2016 PRS guarantees scheme – was the preferred bidder for the new AHGS, and in October 2020 the government formally announced its appointment.

Mr Williamson acknowledges the blow of missing out. “We ground our teeth for some time.”

But he adds: “The best organisations are those that traverse tough times, and get over it and do something about it, and we were experienced enough to know what we do really well.”

THFC had already, two years earlier, launched its funding subsidiary Blend, together with a £2bn Euro Medium-Term Note (EMTN) programme to allow it to issue more flexibly.

In its hour of disappointment, THFC looked to build on this.

“We could see the importance of speed to market, given what was going on with the cost of gilts. The lowest Blend deal we did was about 1.8 per cent for 30 years.”

The company would become the first sector aggregator to offer deferred drawdowns, allowing borrowers to agree pricing upfront for money required at a later date. It is something that Mr Williamson speculates would have been “quite tricky to get through a government guarantee scheme”.

Other innovations saw the company convert its Blend issuance first to social and then to sustainable bonds, in 2021, as it adopted the respective environmental, social and governance frameworks, before launching a dedicated sustainable-labelled finance vehicle in 2023 – THFC Sustainable Finance – to issue via a new £2bn EMTN.

A green future

This focus on sustainability extends into Mr Williamson’s hopes, not only for THFC but also for the sector more broadly. THFC has previously argued for a ‘green guarantee scheme’ to enable housing associations to access cheaper capital markets funding to invest in the improvement of existing homes, as part of a wider mix of funding, as outlined in a 2021 research report.

Indeed, in February this year, the current AHGS under ARA Venn moved some way towards this, opening up to investment in existing homes – provided that additional homes are also delivered.

Meanwhile, Social Housing reported in March that THFC is working with the UK Infrastructure Bank as the latter, which is backed by the Treasury, looks to lend directly to housing associations for decarbonisation projects.

But if Mr Williamson has one dream for THFC from afar, his “big, hairy, audacious goal”, as he puts it, would be the return of EIB funding, channelled towards the decarbonisation challenge.

“When the air leaves us [in the UK], it goes east over Europe. So whether or not we’re in the European Union, there is a vested interest in us doing something about this. And that argument, in the fullness of political time, might have some traction again,” he says.

As for Mr Williamson’s own future, an assortment of activities await – including continuing his hobby as a bass player, in a Cuban jazz band among others. He also remains chair of Newbury Building Society, and in October he will become master of a livery company in the City of London – something he acknowledges is a “bit of an unusual thing to do”.

But Mr Williamson’s mind remains occupied, too, with matters closer to housing and the huge challenges it is facing.

“I don’t want to lose the knowledge that I’ve got,” he tells Social Housing, “I want to put it to good purpose. I’d particularly like to keep my head around what’s going on in the retrofit space, because we’ve learnt so much.

“It’s this crossing point of a number of different disciplines, and no one has really got their brain around all of it yet. But I can see that it’s something that really does need quite a lot ‘doing’.”

If the past 22 years are anything to go by, Mr Williamson is likely to stay his course.

Recent long reads from Social Housing

Waqar Ahmed’s parting request to the banking sector? ‘Take some more risk’

As he looks to step away from the financial helm of L&Q, 27 years after joining the group, Waqar Ahmed speaks to Sarah Williams about massive growth, major restructuring, Westminster’s “most stupid decision” and why the sector’s lenders must (finally) take on more risk

‘It was really the credit crunch that was our making’: Piers Williamson on two decades at THFC

After 22 years at the helm of sector bond aggregator The Housing Finance Corporation, Piers Williamson sits down with Sarah Williams to talk through two decades of turnaround, transactions and traversing market turbulence

‘It’s not something we would ordinarily do’: why the RSH made a payment to a failing provider

At the start of 2023, the English regulator exercised a power it had not used for more than two decades: it gave direct financial assistance to a struggling housing association by providing liquidity support. Sarah Williams reports

Devolution and housing in England – where are we now?

As the Labour government firms up plans for its next set of devolution deals, Social Housing looks at what settlements to date have meant for housing, and what is needed to do more. Robyn Wilson reports

Under the radar? Why housing providers need to talk about fraud

Data on the volume, types and cost of fraud to the social housing sector is hard to come by. Keith Cooper hears from providers and experts about why that matters – and what we do know about recent trends in fraudulent activity

Captive insurance: why more than 15 housing associations are exploring the approach

Michael Lloyd investigates what captive insurance entails and whether it could provide an answer to the sector’s challenges in this area, as Social Housing learns that at least 15 associations are exploring the approach

Sign up for Social Housing’s data analysis newsletter

New to Social Housing? Click here to register and sign up for our data analysis newsletter

The data analysis newsletter is a twice-monthly round-up of Social Housing’s leading data analysis, keeping you up to speed on key trends and pointing you to all the data you need on financial and operating performance in the sector and beyond.

Already have an account? Click here to manage your newsletters.

RELATED