Special report: how do housing associations’ finances compare to others?

Our accounts digest finds that housing associations’ pre-tax surpluses have fallen for the second year running, driven by a drop in sales profits and surpluses from social rent. Chloe Stothart reports

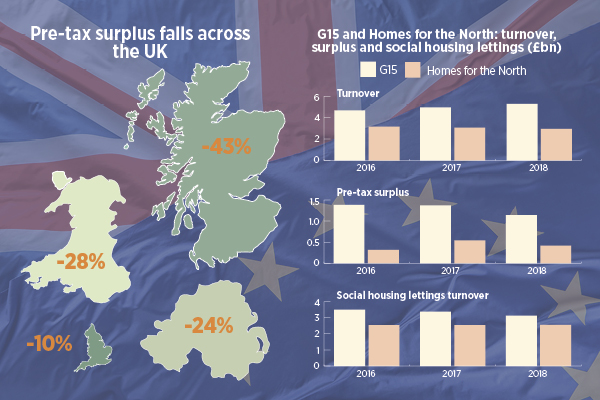

Pre-tax surpluses for housing associations (HAs) in the UK fell in 2019 for the second year in a row as sales profits and surpluses from social rent dropped.

The surplus for the 207 landlords in this report fell by 3.8 per cent to £3.6bn. Two-thirds of the 151 English HAs in the report saw their pre-tax surplus fall in 2019 to give a total in England of £3.4bn, which was a drop of four per cent.

Together Housing saw the largest percentage fall in pre-tax surplus and the biggest overall loss of the HAs in this report with a deficit of £19.8m in 2019. The main cause was breakage costs as part of a refinancing in October 2018. However, spending on fire safety measures also contributed.

Breakage costs were also a factor for Phoenix Community Housing, which had the largest percentage rise in surplus, mainly because refinancing costs had contributed to it making a loss in 2018.

Refinancing costs affected the surpluses of several HAs in 2018 and 2019, which reflects significant borrowing in the period as HAs take advantage of historically low interest rates.

L&Q had the largest pre-tax surplus even though it was down 45 per cent on 2018, followed by Clarion and Peabody, both of which also saw their surpluses fall in 2019.

This report sets out financial results for the HAs that hold the most units in their category across England, Scotland, Wales and Northern Ireland. The definition of traditional, mixed group and large-scale voluntary transfer (LSVT) associations in England for this report is the one used by the Regulator of Social Housing (RSH) in the 2017 global accounts.

The RSH defines an association as LSVT when it obtained more than half its units on the date of transfer from the transfer deal, otherwise it would be classed as traditional. It would also be categorised as an LSVT if all its constituent entities were stock transfers. Mixed groups contain stock transfer and traditional entities.

In the past Social Housing’s mixed category was for HAs that either had a mix of LSVT and traditional associations in their group or had income from first tranche or market sales. However this definition would now cover almost all associations in this report because 90 per cent of the English HAs covered had income from first tranche sales in 2019.

All the HAs in this report use the FRS 102 accounting standard apart from Sanctuary, which uses EU IFRS. It can produce some very different numbers, such as for interest cover and gearing, which are not really comparable with those generated under FRS 102, so we have omitted them for Sanctuary Scotland. For Sanctuary Group, like other organisations in England, we have used the metrics it states in its accounts for the RSH’s value for money figures.

Sales market slowdown

Much has been made of a slowdown in the housing market, particularly in London in the later part of 2018/19.

Profits from development for sale in England dived 42 per cent, while first tranche surpluses held up a bit better, rising four per cent.

One Housing reported a loss on properties for sale of £9.6m in 2019 from a profit of £6.6m in 2018 and a drop in its surplus on first tranche sales to £7.6m from £13m.

L&Q also said it had been hit by the sales slowdown. It made a loss of £9m on market sales, down from a profit of £28m the year before, and its surplus on first tranche sales fell to £16m from £27m. It still made the second-largest surplus on first tranche sales of the associations in this report despite the fall.

UK housing associations: audited accounts 2018/19 summary

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| England | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| 60 LSVT | 663,648 | 3,659 | (2,718) | 26% | (511) | 158 | 682 | 19% | 25,473 | 12,106 | 18,242 | 56% | 196% |

| 32 Mixed | 1,035,723 | 6,188 | (4,484)

| 28% | (950) | 224 | 1,105 | 18% | 51,140 | 22,672 | 21,890 | 52% | 180% |

| 59 Traditional | 1,262,028 | 9,706 | (7,347) | 24% | (1,423) | 446 | 1,575 | 16% | 91,855 | 39,282 | 31,126 | 51% | 181% |

| 151 Total England | 2,961,399 | 19,553 | (14,549) | 26% | (2,884) | 828.3 | 3,362.4 | 17% | 168,467 | 74,060 | 25,009 | 52% | 183% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scotland | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| 1 Wheatley | 50,635 | 334 | (267) | 20% | (57) | 0 | (5) | (2%) | 2,246 | 1,213 | 23,959 | 64% | 235% |

| 5 LSVT | 29,010 | 133 | (111) | 17% | (14) | (1.8) | 14.2 | 11% | 829 | 330 | 11,372 | 45% | 51% |

| 20 Traditional | 95,177 | 559 | (440) | 21% | (55) | 5 | 75 | 14% | 5,150 | 1,545 | 16,232 | 32% | 230% |

| 26 Total Scotland | 174,822 | 1,026 | (817) | 20% | (127) | 3.0 | 84.5 | 8.2% | 8,225 | 3,088 | 17,664 | 41% | 213% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Wales | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| 5 LSVT | 44,486 | 233 | (193) | 17% | (25) | 11.6 | 28.6 | 12% | 1,291 | 373 | 8,393 | 47% | 247% |

| 20 Traditional | 89,041 | 613 | (483) | 21% | (86) | 3.8 | 47.0 | 8% | 6,199 | 2,277 | 25,577 | 43% | 171% |

| 25 Total Wales | 133,527 | 845 | (676) | 20% | (110) | 15.4 | 75.6 | 9% | 7,490 | 2,651 | 19,852 | 44% | 188% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Northern Ireland | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| 5 | 42,927 | 286 | (225) | 21% | (29) | 1.1 | 31.6 | 11% | 3,465 | 940 | 21,893 | 29% | 217% |

| 207 UK total | 3,312,675 | 21,710 | (16,267) | 25% | (3,150) | 848 | 3,554 | 16% | 187,648 | 80,739 | 24,373 | 51% | 183% |

Clarion said its reduction in open market sales profits from a £12.5m profit to a £3.4m loss reflected a slight drop in the number of homes sold from 106 to 97, and lower margins of 17 per cent in 2019 – down from 30 per cent the year before because of “tougher market conditions”. It also had a smaller drop in first tranche profits of £800,000 to £15.7m despite a rise in the number of homes sold from 410 to 489.

Peabody made the largest surplus on market and first tranche sales despite falls of 38 per cent and 29 per cent respectively.

Ian Johnson, chief financial officer at Metropolitan Thames Valley Housing (MTVH) and chair of the G15 finance directors’ group, said: “Inevitably, lower profits from sales reduce the amount available for the cross-subsidisation of affordable homes, specifically social rented homes, and therefore this may cause HAs to consider reining in their development plans.”

He said that in 2019/20, prices for MTVH’s homes were generally holding steady up to the £600,000 maximum price eligible for Help to Buy loans but above that level it was “a bit harder and slower”.

“In London that would be more relevant because more homes are above that,” he added.

Fire safety works and major repairs

Spending on fire safety work following the Grenfell Tower disaster began in 2018, but continued into 2019. Jonathan Pryor, partner at auditor Smith & Williamson, said this would lead to higher major repairs capitalisation, early writing-off of components and higher depreciation charges in the light of expected replacements of materials such as cladding.

England: audited accounts of largest 32 mixed-business registered provider groups

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Onward Homes | 34,786 | 147 | (112) | 24% | (24) | 2.8 | 15.2 | 10% | 1,164 | 300 | 8,611 | 24% | 151% |

Thirteen Group | 33,858 | 180 | (148) | 18% | (10) | 2.4 | 23.1 | 13% | 1,086 | 241 | 7,107 | 23% | 251% |

Torus | 37,561 | 194 | (141) | 27% | (20) | 5.1 | 33.4 | 17% | 993 | 297 | 7,895 | 24% | 329% |

Wythenshawe Community Housing Group | 13,677 | 68 | (62) | 10% | (5) | 3.7 | 6.1 | 9% | 374 | 114 | 8,344 | 30% | 242% |

One Manchester | 12,076 | 58 | (41) | 29% | (8) | 6.3 | 16.2 | 28% | 254 | 124 | 10,260 | 58% | 162% |

Your Housing Group | 27,730 | 149 | (119) | 20% | (15) | 4.8 | 22.1 | 15% | 1,140 | 342 | 12,326 | 34% | 256% |

Mosscare St Vincent’s | 8,520 | 44 | (32) | 29% | (8) | 0.8 | 6.5 | 15% | 388 | 149 | 17,533 | 38% | 196% |

North Star | 3,686 | 20 | (14) | 29% | (3) | 0.2 | 1.7 | 9% | 204 | 89 | 24,014 | 43% | 189% |

ForViva | 23,365 | 148 | (131) | 12% | (10) | 0.7 | 10.0 | 7% | 487 | 170 | 7,279 | 42% | 151% |

Incommunities | 23,200 | 98 | (84) | 15% | (16) | 3.7 | 24.3 | 25% | 456 | 306 | 13,185 | 68% | 168% |

The Wrekin Housing Group | 13,339 | 82 | (53) | 36% | (21) | 0.7 | 9.0 | 11% | 627 | 379 | 28,380 | 63% | 134% |

Cottsway | 4,823 | 33 | (20) | 40% | (9) | 1.6 | 6.0 | 18% | 336 | 192 | 39,809 | 58% | 171% |

Jigsaw Group | 34,679 | 180 | (125) | 31% | (35) | 4.2 | 25.0 | 14% | 1,361 | 673 | 19,403 | 50% | 207% |

Platform Housing Group | 44,317 | 274 | (171) | 38% | (43) | 6.3 | 66.9 | 24% | 2,574 | 1,164 | 26,266 | 44% | 239% |

Karbon | 26,834 | 129 | (98) | 25% | (18) | 1.7 | 6.0 | 5% | 971 | 388 | 14,453 | 44% | 206% |

Peabody | 56,678 | 565 | (416) | 26% | (60) | 24.0 | 148.0 | 26% | 6,304 | 2,199 | 38,798 | 38% | 134% |

Places for People | 197,712 | 827.1 | 626.3 | 24.3 | (141) | 26.3 | 95.5 | 12% | 5,260 | 2,927 | 14,803 | 78% | 134% |

Vivid | 30,521 | 250 | (148) | 41% | (34) | 4.9 | 73.1 | 29% | 2,181 | 1,075 | 35,210 | 53% | 250% |

Optivo | 45,056 | 314 | (223) | 29% | (43) | 12.6 | 87.6 | 28% | 3,141 | 1,275 | 28,299 | 44% | 192% |

Stonewater | 32,354 | 191 | (134) | 30% | (34) | 9.4 | 22.4 | 12% | 1,939 | 918 | 28,372 | 45% | 133% |

Radian | 23,035 | 168 | (109) | 35% | (36) | 5.6 | 31.5 | 19% | 1,648 | 838 | 36,360 | 55% | 192% |

Citizen (WM Housing) | 30,816 | 154 | (111) | 27% | (27) | 1.8 | 21.0 | 14% | 1,298 | 617 | 20,030 | 44% | 184% |

Longhurst Group | 22,778 | 167 | (118) | 29% | (29) | 1.6 | 21.9 | 13% | 1,209 | 587 | 25,768 | 49% | 173% |

RHP | 10,407 | 58 | (38) | 35% | (8) | 0.7 | 13.1 | 23% | 407 | 227 | 21,847 | 59% | 216% |

Plus Dane | 13,681 | 74 | (61) | 18% | (12) | 0.8 | 1.1 | 1% | 621 | 297 | 21,733 | 41% | 155% |

Rooftop | 6,674 | 42 | (25) | 39% | (9) | 0.5 | 7.9 | 19% | 371 | 223 | 33,364 | 61% | 182% |

Bernicia | 14,654 | 74 | (56) | 24% | (7) | 1.7 | 12.9 | 17% | 512 | 132 | 8,991 | 27% | 223% |

GreenSquare Group | 12,056 | 81 | (60) | 26% | (16) | 2.2 | 7.4 | 9% | 867 | 438 | 36,317 | 46% | 138% |

Grand Union Housing Group | 11,921 | 74 | (48) | 35% | (14) | 2.6 | 15.8 | 21% | 648 | 295 | 24,754 | 46% | 176% |

Hyde | 48,796 | 450 | (334) | 26% | (82) | 53.8 | 110.2 | 24% | 3,417 | 1,598 | 32,746 | 51% | 143% |

Clarion Housing Group | 125,881 | 816 | (567) | 31% | (141) | 30.1 | 153.5 | 19% | 8,371 | 3,869 | 30,735 | 53% | 134% |

Progress Housing Group | 10,252 | 78 | (59) | 24% | (9) | 0.7 | 10.9 | 14% | 531 | 232 | 22,664 | 45% | 261% |

| Total | 1,035,723 | 6,188 | (4,484) | 28% | (950) | 224 | 1,105 | 18% | 51,140 | 22,672 | 21,890 | 52% | 180% |

The depreciation charge for the year and capitalised major repairs rose in 2019.

A number of HAs mentioned increased spending on fire safety, including One Housing Group and Together, the latter of which paid for a waking watch and improvements to blocks. But there were other reasons for increased major repairs spend, such as improvement programmes.

EBITDA MRI interest cover

Falls in operating surpluses caused by matters such as drops in sales and the rent reduction, and increases in spending, for example on fire safety, were cited as reasons for a fall in interest cover.

Of the G15 group of London’s largest housing associations, Optivo, A2Dominion, L&Q, Catalyst and One Housing Group all mentioned the slowdown in the sales market as a factor in their reduced EBITDA MRI interest cover results.

MTVH’s EBITDA MRI interest cover dropped to 124 per cent from 159 per cent because of the rent reduction, increased interest payable and investment in homes.

England: audited accounts of largest 59 traditional registered providers

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Castles and Coasts | 7,056 | 34.9 | 25.0 | 28.0 | (4) | 0.5 | 6.2 | 18% | 259 | 76 | 10,742 | 29% | 236% |

Anchor Hanover | 53,441 | 526.4 | 468.5 | 11.0 | (24) | (1.0) | 35.6 | 7% | 1,483 | 536 | 10,024 | 34% | 431% |

PA Housing | 23,059 | 159.5 | 105.6 | 33.8 | (30) | 8.1 | 38.7 | 24% | 1,789 | 712 | 30,885 | 40% | 169% |

Regenda | 13,003 | 68.9 | 53.3 | 22.6 | (8) | 3.0 | 10.3 | 15% | 532 | 192 | 14,799 | 37% | 145% |

Newlon Housing Trust | 7,836 | 80.3 | 54.7 | 31.8 | (15) | 7.2 | 18.2 | 23% | 1,167 | 553 | 70,535 | 48% | 132% |

Westward | 7,536 | 40.2 | 28.0 | 30.4 | (5) | 1.8 | 8.6 | 21% | 383 | 130 | 17,276 | 32% | 208% |

Shepherds Bush Housing Group | 5,109 | 43.2 | 31.5 | 27.1 | (5) | 0.5 | 8.6 | 20% | 477 | 167 | 32,745 | 38% | 211% |

Trident Group | 3,386 | 33.3 | 28.0 | 15.7 | (3) | 0.3 | 2.5 | 8% | 168 | 80 | 23,713 | 49% | 197% |

Colne | 3,288 | 20.3 | 12.8 | 37.0 | (4) | 0.1 | 3.7 | 18% | 239 | 129 | 39,375 | 54% | 303% |

Impact Housing | 3,067 | 20.4 | 17.2 | 15.7 | (11) | 0.2 | 7.7 | 38% | 156 | 73 | 23,795 | 48% | 195% |

EMH Group | 19,599 | 103.8 | 72.9 | 29.8 | (19) | 4.0 | 15.9 | 15% | 887 | 434 | 22,135 | 51% | 184% |

Swan Housing Association | 10,905 | 81.1 | 58.8 | 27.5 | (15) | 3.10 | 9.8 | 12% | 1,032 | 619 | 56,794 | 71% | 125% |

Nottingham Community Housing Association | 9,415 | 77.1 | 61.6 | 20.1 | (11) | 4.2 | 8.5 | 11% | 608 | 267 | 28,371 | 43% | 162% |

Irwell Valley Housing | 7,675 | 35.9 | 27.2 | 24.2 | (5) | 0.6 | 4.2 | 11.6% | 327 | 136 | 17,766 | 41% | 146% |

Wandle | 7,500 | 68.6 | 47.0 | 31.4 | (13) | 8.6 | 18.8 | 27% | 904 | 307 | 40,896 | 33% | 150% |

SYHA | 5,753 | 48.7 | 42.4 | 12.9 | (5) | 1.0 | 2.3 | 5% | 332 | 134 | 23,273 | 41% | 124% |

Hexagon | 4,430 | 41.6 | 32.7 | 21.2 | (5) | 3.1 | 6.8 | 16% | 480 | 195 | 44,128 | 40% | 171% |

Salvation Army Housing Association | 4,154 | 36.1 | 32.8 | 9.4 | (2) | 0.1 | 1.8 | 5% | 200 | 31 | 7,373 | 13% | 227% |

Bournville Village Trust | 3,977 | 27.4 | 22.2 | 18.8 | (5) | 1.1 | 4.1 | 15% | 186 | 98 | 24,524 | 63% | 144% |

Orwell Housing† | 3,835 | 38.5 | 30.6 | 20.6 | (3) | 0.3 | 4.0 | 10% | 233 | 88 | 22,918 | 39% | 206% |

Connect Housing | 3,484 | 20.4 | 16.6 | 18.9 | (2) | 0.31 | 2.2 | 11% | 137 | 48 | 13,727 | 36% | 213% |

Staffordshire Housing Association | 3,144 | 21.5 | 16.6 | 23.0 | (3) | (0.1) | 2.2 | 10% | 159 | 69 | 21,903 | 42% | 174% |

Notting Hill Genesis | 65,458 | 670.6 | 534.1 | 20.4 | (109) | 34.0 | 105.3 | 16% | 8,483 | 3,576 | 54,634 | 50% | 143% |

The Guinness Partnership | 64,944 | 360.5 | 274.7 | 23.8 | (67) | 70.0 | 92.6 | 26% | 3,450 | 1,250 | 19,249 | 41% | 148% |

LiveWest | 37,329 | 232.9 | 166.7 | 28.4 | (24) | 15.3 | 56.0 | 24% | 2,149 | 806 | 21,597 | 40% | 267% |

Hastoe Group | 7,630 | 32.8 | 20.4 | 37.8 | (11) | 1.7 | 2.7 | 8% | 450 | 251 | 32,910 | 56% | 116% |

Broadland Housing | 5,118 | 29.0 | 21.4 | 26.4 | (6) | 0.2 | 2.0 | 7% | 322 | 169 | 33,020 | 52% | 145% |

Housing & Care 21 | 21,009 | 186.4 | 150.6 | 19.2 | (27) | 1.0 | 18.1 | 10% | 1,506 | 602 | 28,660 | 34% | 151% |

Sanctuary Group* | 101218 | 735.4 | 557.5 | 24.2 | (130) | 22.7 | 76.9 | 10% | 4,088 | 2,816 | 27816 | 52% | 121% |

Moat | 20,636 | 130.4 | 92.8 | 28.9 | (19) | 11.4 | 36.3 | 28% | 1,598 | 512 | 24,834 | 35% | 208% |

Metropolitan Thames Valley Housing | 57,043 | 410.8 | 298.1 | 27.5 | (77) | 31.2 | 6.5 | 2% | 4,905 | 2,011 | 35,254 | 42% | 124% |

Catalyst | 20,898 | 180.1 | 134.8 | 25.2 | (25) | 12.0 | 30.0 | 17% | 2,493 | 687 | 32,878 | 30% | 154% |

Octavia Housing | 5,087 | 58.7 | 48.8 | 17.0 | (6) | 2.8 | 6.5 | 11% | 566 | 211 | 41,392 | 38% | 165% |

Origin Housing | 6,690 | 56.1 | 40.5 | 27.9 | (14) | 3.1 | 12.3 | 22% | 796 | 357 | 53,300 | 47% | 75% |

Equity Housing Group | 4,862 | 24.1 | 19.1 | 20.5 | (2) | 0.9 | 3.5 | 14% | 215 | 51 | 10,529 | 24% | 198% |

Johnnie Johnson Housing | 4,921 | 24.2 | 19.3 | 20.3 | (3) | 1.1 | 2.8 | 12% | 140 | 65 | 13,257 | 43% | 166% |

Hightown Housing Association | 6,383 | 84.7 | 58.6 | 30.9 | (11) | 3.3 | 18.7 | 22% | 759 | 444 | 69,604 | 55% | 248% |

Muir Group | 5,616 | 30.4 | 23.2 | 23.7 | (3) | 0.6 | 4.9 | 16% | 230 | 68 | 12,122 | 27% | 286% |

Home Group | 55,424 | 367.3 | 287.0 | 21.9 | (44) | 5.9 | 47.0 | 13% | 2,822 | 1,218 | 21,981 | 48% | 189% |

Estuary Housing | 4,511 | 40.3 | 30.0 | 25.5 | (7) | 1.8 | 3.6 | 9% | 441 | 212 | 46,926 | 54% | 165% |

Sovereign | 57,987 | 402.1 | 261.8 | 34.9 | (56) | 6.6 | 98.9 | 25% | 4,002 | 1,709 | 29,472 | 45% | 245% |

Orbit | 43,470 | 316.4 | 229.9 | 27.3 | (47) | 29.9 | 42.1 | 13% | 2,892 | 1,425 | 32,777 | 51% | 100% |

Paradigm | 14,908 | 130.1 | 82.2 | 36.8 | (29) | 5.9 | 25.2 | 19% | 1,375 | 698 | 46,807 | 54% | 163% |

A2Dominion | 38,133 | 372.2 | 318.6 | 14.4 | (60) | 9.7 | 25.5 | 7% | 3,918 | 1,618 | 42,433 | 55% | 88% |

Bromford | 43,674 | 256.7 | 179.9 | 29.9 | (39.7) | 6.6 | 69.1 | 27% | 2,584 | 1,182 | 27,065 | 39% | 182% |

Great Places Housing Group | 19,305 | 109.1 | 76.4 | 30.0 | (25) | 3.6 | 13.5 | 12% | 1,203 | 548 | 28,373 | 46% | 146% |

Midland Heart | 33,454 | 219.3 | 151.5 | 30.9 | (25) | 8.8 | 53.5 | 24% | 1,654 | 530 | 15,830 | 30% | 283% |

Accent Group | 20,623 | 94.9 | 74.4 | 21.7 | (15) | 0.6 | 52.8 | 56% | 741 | 315 | 15,256 | 40% | 168% |

L&Q | 95,539 | 937.0 | 739.0 | 21.1 | (111) | 50.0 | 186.0 | 20% | 12,523 | 4,992 | 52,251 | 46% | 166% |

Yorkshire Housing | 16,697 | 113.0 | 80.2 | 29.1 | (18) | 1.6 | 18.0 | 16% | 983 | 451 | 27,023 | 47% | 178% |

Riverside | 56,089 | 364.3 | 296.7 | 18.5 | (48) | 11.9 | 27.0 | 7% | 2,360 | 860 | 15,339 | 38% | 159% |

Southern Housing Group | 28,334 | 230.5 | 168.6 | 26.9 | (34) | 9.7 | 39.4 | 17% | 2,256 | 845 | 29,805 | 37% | 158% |

Network Homes | 21,235 | 275.1 | 178.0 | 35.3 | (27) | 7.4 | 72.1 | 26% | 2,107 | 941 | 44,309 | 44% | 285% |

One Housing | 16,308 | 213.3 | 182.4 | 14.4 | (32) | 15.4 | 20.1 | 9% | 2,229 | 1,002 | 61,466 | 49% | 83% |

Habinteg | 3,391 | 22.9 | 16.9 | 26.3 | (3) | 0.020 | 2.3 | 10% | 211 | 43 | 12,822 | 18% | 247% |

Leeds Federated | 4,304 | 26.0 | 19.4 | 25.3 | (3) | 0.9 | 6.2 | 24% | 212 | 48 | 11,205 | 24% | 340% |

Aldwyck | 11,150 | 95.8 | 63.6 | 33.6 | (19) | 0.0 | 32.8 | 34% | 803 | 443 | 39,713 | 62% | 134% |

BPHA | 18,721 | 124.5 | 71.4 | 42.6 | (34) | 10.9 | 34.1 | 27% | 1,291 | 787 | 42,044 | 66% | 156% |

Accord | 13,277 | 119.6 | 92.3 | 22.8 | (17) | 0.5 | 10.2 | 9% | 956 | 464 | 34,981 | 50% | 158% |

| Total | 1,262,028 | 9,706 | (7,347) | 24% | (1,423) | 446 | 1,575 | 16% | 91,855 | 39,282 | 31,126 | 51% | 181% |

Salix Homes had the largest drop in its EBITDA MRI from -90 per cent to -788 per cent. Salix said its figure would remain lower than its peer group average in 2019/20 because it is investing in Decent Homes. It is a relatively new stock transfer that took place in 2015 so its EBITDA MRI will be affected by high levels of investment to meet transfer promises.

Cobalt had the highest interest cover, which it attributed to low levels of borrowing and costs.

Pensions

The major change in the 2019 accounts was each HA stating the share of its liabilities in the Social Housing Pension Scheme (SHPS) or the Scottish Housing Associations’ Pension Scheme.

Mr Pryor said that the change in accounting treatment had led to significant increases in pension provisions, which for most providers had limited impact on the overall financial position of the association due to historically high levels of reserves. He added that, on the other hand, there would be less volatility in the surpluses recorded in the income statement because changes to the schedule of contributions to remedy the deficit would no longer be reflected as an expense.

The increase in pension liabilities is easy to see because the 2018 figures were not restated to reflect the rule change. The 151 English HAs in this report saw a collective 66 per cent rise in pension liabilities reaching £2.8bn in 2019.

England: audited accounts of largest 60 LSVT registered providers

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Together Housing Group | 36,512 | 177.5 | 154.6 | 13% | (27) | 5.1 | (19.8) | (11%) | 1,153 | 582 | 15,953 | 56% | 54% |

WDH | 31,439 | 155.6 | 124.5 | 20% | (19) | 2.73 | 14.9 | 10% | 849 | 420 | 13,343 | 47% | 193% |

Gentoo | 29,952 | 177.1 | 142.7 | 19% | (25) | 2.1 | 13.2 | 7% | 1,173 | 542 | 18,098 | 52% | 150% |

Flagship Group | 28,207 | 155.7 | 101.4 | 35% | (24) | 5.9 | 131.6 | 85% | 1,720 | 699 | 24,787 | 38% | 222% |

Believe (County Durham Housing Group) | 18,315 | 66.6 | 49.2 | 26% | (6) | 5.0 | 16.7 | 25% | 218 | 115 | 6,279 | 45% | 107% |

Bolton at Home | 17,580 | 83.1 | 73.0 | 12% | (4) | 3.9 | 5.3 | 6% | 182 | 30 | 1,706 | 9% | (86%) |

Plymouth Community Homes | 15,961 | 80.2 | 64.5 | 19% | (4) | 0.6 | 12.9 | 16% | 579 | 111 | 6,961 | 19% | 308% |

Knowsley Housing Trust | 13,251 | 68.2 | 57.1 | 16% | (8) | 3.3 | 3.3 | 5% | 263 | 187 | 14,124 | 67% | 185% |

Curo | 13,222 | 93.2 | 66.3 | 29% | (10) | 2.4 | 19.4 | 21% | 612 | 273 | 20,683 | 52% | 291% |

Rochdale Boroughwide Housing | 12,923 | 56.2 | 41.7 | 26% | (3) | 3.3 | 15.0 | 27% | 176 | 43 | 3,305 | 17% | 436% |

Housing Plus Group | 12,194 | 62.6 | 46.0 | 27% | (16) | 1.4 | 2.0 | 3% | 395 | 283 | 23,237 | 77% | 126% |

First Choice Homes Oldham | 11,445 | 49.8 | 39.6 | 21% | (3) | 1.7 | 7.5 | 15% | 239 | 25 | 2,204 | 9% | (20%) |

Greenfields Community Housing | 8,740 | 47.6 | 30.6 | 36% | (7) | 0.3 | 11.0 | 23% | 372 | 156 | 17,849 | 37% | 287% |

Vale of Aylesbury Housing | 8,313 | 49.9 | 38.6 | 23% | (5) | 0.6 | 7.4 | 15% | 316 | 119 | 14,290 | 40% | 284% |

Silva (Bracknell Forest Homes) | 7,533 | 45.3 | 32.8 | 28% | (6) | 0.9 | 7.7 | 17% | 461 | 149 | 19,780 | 31% | 221% |

Halton Housing Trust | 7,295 | 36.7 | 27.5 | 25% | (6) | 1.2 | 4.0 | 11% | 206 | 134 | 18,406 | 81% | 146% |

Raven Housing Trust | 6,757 | 44.5 | 29.7 | 33% | (7) | 1.6 | 11.6 | 26% | 356 | 217 | 32,055 | 67% | 194% |

Red Kite Community Housing | 6,497 | 34.7 | 25.5 | 27% | (3) | 0.8 | 8.9 | 26% | 226 | 79 | 12,233 | 26% | 207% |

Lincolnshire Housing Partnership | 12,552 | 53.6 | 44.8 | 16% | (11) | 1.0 | (1.1) | (2%) | 294 | 152 | 12,110 | 51% | 43.23% |

Calico | 5,045 | 22.4 | 16.8 | 25% | (4) | 1.2 | 2.7 | 12% | 130 | 110 | 21,843 | 93% | 130.2% |

One Vision Housing | 13,235 | 60.4 | 48.3 | 20% | (8) | 1.4 | 6.9 | 11% | 271 | 178 | 13,486 | 71% | 148.26% |

Magenta Living | 12,705 | 67.3 | 61.7 | 8% | (4) | 1.9 | 8.4 | 13% | 245 | 81 | 6,383 | 35% | 453.6% |

Beyond Housing | 15,097 | 73.7 | 57.4 | 22% | (11) | 1.6 | 6.8 | 9% | 374 | 200 | 13,248 | 54% | 192% |

Connexus (Shropshire Housing) | 10,693 | 60.4 | 45.3 | 25% | (9) | 2.1 | 8.4 | 14% | 394 | 223 | 20,827 | 63% | 168.27% |

Yarlington Housing Group | 10,409 | 63.9 | 44.9 | 30% | (8) | 2.9 | 14.1 | 22% | 579 | 220 | 21,178 | 30% | 221.3% |

Futures Housing Group | 10,010 | 50.6 | 33.5 | 34% | (9) | 1.2 | 11.2 | 22% | 302 | 219 | 21,832 | 81% | 218% |

Livin | 8,408 | 34.5 | 25.0 | 28% | (5) | 1.2 | 23.3 | 67% | 147 | 91 | 10,823 | 68% | 29.5% |

Acis Group | 7,400 | 33.6 | 23.1 | 31% | (6) | 0.3 | 4.5 | 13% | 270 | 184 | 24,842 | 68% | 160.4% |

Havebury Housing Partnership | 6,569 | 42.1 | 29.0 | 31% | (9) | 0.8 | 5.3 | 13% | 350 | 186 | 28,290 | 54% | 154% |

Southway Housing Trust | 6,201 | 31.7 | 24.2 | 24% | (3) | 2.8 | 7.2 | 23% | 164 | 54 | 8,636 | 29% | 301% |

Community Gateway Association | 6,632 | 28.6 | 20.2 | 29% | (4) | 0.7 | 5.1 | 18% | 182 | 73 | 10,983 | 42% | 240% |

The Community Housing Group | 6,062 | 39.2 | 29.2 | 25% | (7) | 1.3 | 3.9 | 10% | 226 | 150 | 24,699 | 69% | 112.36% |

Cobalt Housing Limited | 5,942 | 27.5 | 20.9 | 24% | (2) | 1.5 | 6.0 | 22% | 175 | 30 | 5,049 | 5% | 549% |

Trent & Dove Housing | 6,154 | 30.9 | 20.5 | 34% | (5) | 1.7 | 7.4 | 24% | 187 | 110 | 17,875 | 59% | 242% |

Housing Solutions | 5,713 | 45.8 | 27.4 | 40% | (13) | 1.2 | 3.3 | 7% | 575 | 291 | 50,897 | 51% | 145.73% |

Cheshire Peaks & Plains | 5,268 | 29.7 | 20.2 | 32% | (4) | 0.7 | 6.0 | 20% | 151 | 77 | 14,681 | 52% | 194% |

Salix Homes | 8,716 | 38.9 | 30.5 | 22% | (2) | 2.5 | 6.6 | 17% | 227 | 37 | 4,209 | 28% | (788%) |

Soha Housing | 6,939 | 48.7 | 30.0 | 38% | (10) | 2.3 | 10.9 | 22% | 576 | 224 | 32,341 | 39% | 198.8% |

Poplar Harca | 9,485 | 75.0 | 49.0 | 35% | (13) | 33.9 | 47.9 | 64% | 564 | 272 | 28,658 | 48% | 218% |

Town and Country Housing | 8,962 | 64.7 | 38.6 | 40% | (14) | 4.0 | 16.2 | 25% | 824 | 384 | 42,826 | 48% | 191% |

Saxon Weald | 6,635 | 46.0 | 29.3 | 36% | (12) | 1.1 | 6.3 | 14% | 355 | 222 | 33,391 | 68% | 132% |

CHP | 10,055 | 65.4 | 46.7 | 29% | (17) | 1.6 | 2.6 | 4% | 690 | 434 | 43,114 | 63% | 141% |

Weaver Vale Housing Trust | 6,248 | 32.5 | 25.1 | 23% | (3) | 1.1 | 0.6 | 2% | 111 | 65 | 10,347 | 61% | 236% |

Settle (North Hertfordshire Homes) | 9,385 | 68.0 | 48.7 | 28% | (11) | 1.8 | 10.5 | 15% | 466 | 283 | 30,169 | 59% | 209% |

WHG | 21,065 | 108.6 | 77.0 | 29% | (20) | 6.8 | 18.8 | 17% | 605 | 406 | 19,296 | 65% | 151% |

Aster Group | 30,791 | 211.9 | 152.3 | 28% | (28) | 17.6 | 55.0 | 26% | 1,821 | 960 | 31,193 | 52% | 222.8% |

Trafford Housing Trust | 8,966 | 57.1 | 49.9 | 13% | (7) | 3.8 | 4.4 | 8% | 273 | 177 | 19,685 | 86% | 201.12% |

Stafford & Rural Homes | 6,365 | 31.1 | 20.9 | 33% | (4) | 1.2 | 7.8 | 25% | 201 | 80 | 12,569 | 36% | 267% |

Alliance Homes Group | 6,610 | 43.7 | 32.8 | 25% | (2) | 0.3 | 2.4 | 6% | 192 | 90 | 13,623 | 40% | 124.6% |

Freebridge Community Housing | 6,811 | 31.0 | 23.7 | 23% | (2) | 0.8 | 5.9 | 19% | 122 | 53 | 7,708 | 34% | 369% |

Ongo | 10,182 | 45.0 | 34.0 | 24% | (3) | 1.0 | 9.4 | 21% | 207 | 59 | 5,819 | 24% | 377% |

Watford Community Housing | 5,355 | 34.9 | 23.6 | 32% | (6) | 0.2 | 5.9 | 17% | 317 | 155 | 28,991 | 44% | 182% |

Phoenix Community Housing | 6,253 | 33.1 | 25.8 | 22% | (3) | 1.5 | 6.1 | 18% | 238 | 80 | 12,714 | 30% | 239% |

West Kent Housing Association† | 7,308 | 52.7 | 34.3 | 35% | (7) | 1.3 | 12.5 | 24% | 635 | 252 | 34,446 | 36% | 238% |

Broadacres Housing Association | 6,316 | 43.7 | 33.8 | 23% | (6) | (0.3) | 3.5 | 8% | 338 | 136 | 21,582 | 41% | 205% |

Selwood Housing | 6,560 | 41.6 | 28.6 | 31% | (3) | 1.6 | 11.8 | 28% | 445 | 153 | 23,296 | 30% | 464% |

Magna Housing | 8,973 | 45.8 | 33.1 | 28% | (5) | 3.3 | 11.0 | 24% | 386 | 127 | 14,190 | 29% | 322.4% |

Golding Homes | 7,579 | 50.9 | 37.4 | 26% | (6.6) | 0.7 | 7.9 | 15% | 476 | 212 | 27,960 | 41% | 248.4% |

Saffron Housing Trust | 6,394 | 36.1 | 24.9 | 31% | (9) | 0.5 | 2.7 | 8% | 284 | 166 | 25,916 | 53% | 133.4% |

Cross Keys Homes | 11,464 | 72.6 | 50.7 | 30% | (13) | 1.2 | 13.5 | 19% | 607 | 287 | 25,025 | 49% | 210% |

| Total | 663,648 | 3659.4 | 2718.3 | 26% | (511) | 158 | 682.1 | 19% | 25,473 | 12,106 | 18,242 | 56% | 196.26% |

The Guinness Partnership had the largest rise in its pension provision from £5.6m to £91.7m because of the switch to defined benefit accounting for SHPS, in which it had a liability of £86.8m in 2019. But the provision was more than offset by a rise in current assets so that reserves still increased – albeit by a much smaller amount.

The Scottish HAs in this report also saw an overall rise in their collective pension liability in 2019, which grew by 111 per cent to £97m.

The biggest rises in pension provision in Scotland and Wales were at Bield and Pennaf, respectively, and both were down to the recognition of SHPS on the balance sheet in 2019.

LSVT

Gearing held steady across LSVT associations, although this ranged from 92.8 per cent at Calico to 5.2 per cent at Cobalt. Cobalt said that its gearing was below budget because a major property purchase did not go ahead and the seller withdrew, but that it will rise in 2020/21 as developments start.

Calico said its gearing figure was high as a result of “initial full costs of assets at transfer, our continuing reinvestment, new development and growth”.

Scotland: audited accounts of largest 26 RSLs

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 Traditional | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

North Glasgow HA | 5,424 | 25 | (23) | 6% | (1.1) | 0.0 | 0.4 | 1% | 116 | 26 | 4,863 | 28% | 452% |

Hanover (Scotland) HA | 5,419 | 38 | (34) | 10% | (1.5) | (0.1) | 2.1 | 5.7% | 178 | 35 | 6,450 | 21% | 222% |

Bield Housing & Care | 4,614 | 42 | (40) | 6% | (0.4) | (0.0) | 2.6 | 6% | 145 | 2 | 482 | 2% | 758% |

Caledonia HA | 5,590 | 36 | (30) | 16% | (4.0) | (0.2) | 7.6 | 21% | 322 | 84 | 14,976 | 27% | 169% |

Kingdom | 4,545 | 30 | (22) | 26% | (3.2) | 0.1 | 5.0 | 17% | 405 | 101 | 22,205 | 27% | 271% |

Thenue Housing | 3,078 | 17 | (12) | 26% | (1.7) | 0.0 | 1.1 | 7% | 21 | 39 | 12,617 | 26% | 294% |

Maryhill Housing | 3,054 | 13 | (13) | 4% | (0.8) | (0.1) | 0.0 | 0% | 66 | 12 | 3,811 | 20% | 58% |

Hillcrest Homes | 8,867 | 53 | (45) | 16% | (5.8) | 1.4 | 5.1 | 10% | 542 | 173 | 19,456 | 37% | 175% |

Link Group | 8,252 | 65 | (54) | 17% | (6.7) | 0.0 | 4.5 | 7% | 614 | 181 | 21,948 | 34% | 217% |

Castle Rock Edinvar | 7,023 | 36 | (19) | 48% | (0.9) | 0.2 | 16.7 | 46% | 460 | 67 | 9,609 | 15% | 902% |

Sanctuary Scotland* | 6,870 | 33 | (16) | 51% | (8.7) | (0.0) | 8.0 | 24% | 326 | 230 | 33,412 | - | - |

Home Group Scotland | 4,187 | 23 | (15) | 34% | (2.2) | 0.1 | 5.8 | 25% | 277 | 88 | 21,012 | 32% | 399% |

Grampian HA | 3,910 | 19 | (14) | 30% | (3.4) | 0.2 | 3.9 | 20% | 237 | 80 | 20,399 | 36% | 186% |

Clyde Valley HA | 3,961 | 21 | (15) | 30% | (4.1) | 0.1 | 2.7 | 13% | 325 | 115 | 28,920 | 40% | 170% |

West of Scotland HA | 3,546 | 19 | (17) | 14% | (1.7) | 0.0 | 0.9 | 5% | 218 | 61 | 17,313 | 29% | 189% |

Cairn | 3,956 | 18 | (16) | 14% | (2.1) | 0.2 | 2.0 | 11% | 141 | 58 | 14,636 | 48% | 235% |

Albyn Housing | 3,339 | 21 | (16) | 25% | (2.6) | (0.0) | 2.6 | 13% | 272 | 74 | 22,253 | 29% | 158% |

Langstane HA | 3,031 | 16 | (13) | 21% | (1.9) | 0.0 | 0.3 | 2% | 158 | 47 | 15,549 | 31% | 143% |

Port of Leith HA | 2,898 | 18 | (14) | 19% | (1.8) | 0.9 | 2.5 | 14% | 210 | 56 | 19,182 | 30% | 190% |

Govanhill HA | 2,789 | 16 | (14) | 13% | (0.5) | 2.0 | 1.5 | 10% | 119 | 17 | 6,105 | 15% | 47% |

| Total traditional | 95,177 | 559 | (440) | 21% | (55.3) | 4.8 | 75.5 | 14% | 5,150 | 1,545 | 16,232 | 32% | 230% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 LSVT | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Net interest, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Dumfries and Galloway Housing Partnership | 10,339 | 46 | (34) | 25% | (6.7) | 0.0 | 4.9 | 11% | 272 | 167 | 16,184 | 79% | 195% |

River Clyde Homes | 5,681 | 27 | (27) | (1%) | (3.5) | 0.0 | 4.0 | 15% | 203 | 78 | 13,731 | 39% | (286%) |

Hebridean Housing Partnership | 2,199 | 11 | (8) | 26% | (0.3) | (0.2) | 2.4 | 21% | 95 | 5 | 2,232 | 6% | (1,270%) |

Scottish Borders Housing Association | 5,649 | 23 | (19) | 15% | (1.7) | (1.5) | 0.3 | 1% | 82 | 28 | 4,886 | 39% | 41% |

Argyll Community Housing Association | 5,142 | 26 | (21) | 17% | (1.8) | (0.1) | 2.6 | 10% | 177 | 52 | 10,123 | 31% | 405% |

| Total LSVT | 29,010 | 133 | (111) | 17% | (14.1) | (1.8) | 14.2 | 11% | 829 | 330 | 11,372 | 45% | 51% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 Wheatley | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| Wheatley | 50,635 | 334 | (267) | 20% | (57.4) | 0.0 | (5.2) | (2%) | 2,246 | 1,213 | 23,959 | 64% | 235% |

| Total Scotland | 174,822 | 1,026 | (817) | 20% | (126.8) | 3.0 | 84.5 | 8% | 8,225 | 3,088 | 17,664 | 41% | 213% |

Gearing for LSVTs was slightly higher than for other types of landlord because stock transfer organisations start out indebted as they borrow to improve properties as part of transfer promises. However, the debt eventually reduces and the difference in costs and gearing between transfers and traditional associations tends to disappear after about 12 years.

Mixed

Of the mixed associations, Places for People had the highest gearing of a mixed HA at 77.5 per cent. But it believes that the RSH’s chosen metric does not fully represent its activities as it excludes investment properties and investments in joint ventures, which would take its gearing down to 56.7 per cent.

Thirteen had the lowest gearing of the mixed groups at 23.3 per cent but it said it expects this to rise as it draws further loans. It includes stock transfers from Hartlepool and Stockton councils as well as traditional associations.

Northern Ireland: audited accounts of largest five housing associations

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Apex | 5,775 | 50.7 | (41.5) | 18% | (6.5) | 0.56 | 2.2 | 4% | 671 | 201 | 34,844 | 31% | 104.82 |

Choice Housing Ireland | 10,310 | 68.8 | (52.3) | 24% | (8.4) | 0.51 | 8.6 | 13% | 944 | 275 | 26,706 | 34% | 235.58 |

Co-Ownership Housing | 8,766 | 42.9 | (35.5) | 17% | (1.0) | (0.78) | 6.1 | 14% | 464 | 156 | 17,739 | 38% | 829.94 |

Clanmil | 5,035 | 34.3 | (23.4) | 32% | (5.3) | 0.37 | 5.6 | 16% | 513 | 153 | 30,477 | 32% | 244.87 |

Radius | 13,041 | 89.7 | (72.2) | 19% | (7.3) | 0.45 | 9.1 | 10% | 873 | 154 | 11,829 | 18% | 287.22 |

| Total Northern Ireland | 42,927 | 286 | (225) | 21% | (29) | 1.1 | 31.6 | 11% | 3,465 | 940 | 21,893 | 29% | 217% |

Traditional

Swan had the highest gearing of the traditional HAs in England because of Greater London Authority loans, but it said it stress-tested its business plan and was “comfortable” with its level of debt. Its key covenants were not compromised and its gearing is set to decrease over three years, it said.

Salvation Army Housing Association had the lowest gearing at 13.4 per cent.

Scotland

The pre-tax surplus in Scotland fell by 1.1 per cent. Wheatley, Scotland’s largest association, had the biggest percentage fall, going from a £6.9m surplus in 2018 to a £5.3m deficit a year later. This was the result of a loss on revaluation of investment property and a movement in fair value of financial instruments.

Wales

In Wales, however, the pre-tax surplus rose 18 per cent. Traditional HA Wales & West had the largest percentage fall in pre-tax surplus of 104 per cent to a £0.3m deficit because of loan breakage costs and an exceptional pension charge in relation to the SHPS defined benefit scheme.

Wales: audited accounts of largest 25 RSLs

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 Traditional | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Ateb Group | 2,792 | 16 | (10) | 34% | (3.3) | 0.02 | 4.5 | 28% | 220 | 80 | 28,509 | 39% | 139% |

Cadwyn Housing Association | 2,051 | 14 | (12) | 17% | (1.3) | 0.03 | 1.0 | 7% | 103 | 38 | 18,734 | 41% | 156% |

Cardiff Community | 3,057 | 28 | (24) | 14% | (2.2) | 0.11 | 2.3 | 8% | 206 | 64 | 20,995 | 37% | 118% |

Grwp Cynefin | 3,952 | 26 | (21) | 19% | (2.8) | 0.17 | 1.7 | 6% | 337 | 108 | 27,348 | 39% | 192% |

Hendre | 6,097 | 55 | (47) | 15% | (5.0) | 0.54 | 3.9 | 7% | 384 | 129 | 21,153 | 44% | 264% |

Linc Cymru | 4,489 | 38 | (32) | 17% | (4.4) | 0.32 | 2.9 | 8% | 354 | 139 | 31,005 | 48% | 166% |

Melin Homes | 4,141 | 24 | (21) | 15% | (3.0) | 0.00 | 0.7 | 3% | 302 | 104 | 25,104 | 41% | 218% |

Merthyr Tydfil | 1,134 | 6 | (4) | 24% | (0.6) | (0.03) | 0.7 | 12% | 68 | 13 | 11,843 | 23% | 334% |

Mid Wales HA | 1,792 | 9 | (6) | 31% | (2.0) | 0.00 | 0.7 | 8% | 133 | 53 | 29,369 | 49% | 169% |

North Wales HA | 2,670 | 16 | (12) | 28% | (2.9) | 0.04 | 1.8 | 11% | 175 | 57 | 21,435 | 35% | 232% |

United Welsh HA | 5,879 | 36 | (25) | 32% | (8.5) | 0.04 | 3.9 | 11% | 544 | 209 | 35,568 | 47% | 153% |

Bro Myrddin HA | 912 | 5 | (4) | 22% | (0.4) | 0.07 | 0.8 | 15% | 58 | 15 | 16,633 | 30% | 380% |

Cadarn | 3,068 | 16 | (12) | 25% | (2.8) | 0.25 | 1.8 | 11% | 205 | 68 | 22,300 | 36% | 224% |

Coastal | 5,814 | 35 | (25) | 29% | (6.6) | 1.51 | 3.8 | 11% | 448 | 173 | 29,833 | 45% | 149% |

Cynon Taf Community Housing Group | 1,864 | 12 | (10) | 16% | (1.1) | 0.00 | 0.8 | 7% | 102 | 29 | 15,456 | 30% | 201% |

Family Housing Association (Wales) | 2,855 | 22 | (15) | 29% | (4.6) | 0.02 | 1.7 | 8% | 208 | 78 | 27,251 | 40% | 172% |

Pennaf | 5,998 | 43 | (34) | 22% | (7.2) | 0.41 | 3.0 | 7% | 433 | 206 | 34,286 | 53% | 139% |

Pobl | 17,297 | 135 | (112) | 17% | (17.3) | (0.10) | 10.2 | 8% | 1136 | 463 | 26,788 | 51% | 133% |

Taff | 1,440 | 12 | (10) | 21% | (1.4) | 0.00 | 1.2 | 10% | 117 | 36 | 25,327 | 35% | 222% |

Wales and West | 11,739 | 64 | (48) | 25% | (8.2) | 0.40 | (0.3) | 0% | 667 | 213 | 18,185 | 36% | 201% |

| Total traditional | 89,041 | 613 | (483) | 21% | (85.6) | 3.78 | 47.0 | 8% | 6199 | 2277 | 25,577 | 43% | 171% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 LSVT | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

Cartrefi Cymunedol Gwynedd | 6,303 | 35 | (26) | 24% | (3.8) | 2.25 | 6.8 | 20% | 163 | 69 | 10,897 | 47% | 443% |

Bron Afon Community Housing | 8,085 | 46 | (39) | 14% | (3.5) | 3.38 | 5.9 | 13% | 392 | 84 | 10,433 | 52% | 130% |

Newport City Homes | 9,655 | 49 | (43) | 11% | (6.0) | 3.64 | 3.5 | 7% | 178 | 63 | 6,525 | 49% | 163% |

Tai Tarian | 9,537 | 49 | (37) | 24% | (7.4) | 2.59 | 6.2 | 13% | 373 | 90 | 9,483 | 48% | 274% |

Trivallis | 10,906 | 54 | (46) | 15% | (3.8) | (0.28) | 6.2 | 11% | 185 | 67 | 6,135 | 40% | 240% |

| Total LSVT | 44,486 | 233 | (193) | 17% | (24.5) | 11.57 | 28.6 | 12% | 1291 | 373 | 8,393 | 47% | 247% |

| Income and expenditure account | Balance sheet | Financial ratios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018/19 total | Number of units | Gross turnover, £m | Operating costs, £m | Operating surplus/turnover, % | Interest payable, £m | Surplus on sales, £m | Pre-tax surplus, £m | Pre-tax surplus/ turnover | Assets total, £m | Loans total, £m | Per unit, £ | Gearing, % | EBITDA MRI interest cover |

| Total Wales | 133,527 | 845 | (676) | 20% | (110.1) | 15.35 | 75.6 | 9% | 7490 | 2651 | 19,852 | 44% | 188% |

LSVT Bron Afon saw the biggest rise of 511 per cent to a surplus of £5.9m because of a bigger operating surplus and increased surplus on sale of fixed assets. Pobl, Wales’s largest association by units, had the largest pre-tax surplus overall at £10.2m.

Northern Ireland

The five Northern Irish HAs covered in this report saw a 23 per cent rise in their pre-tax surpluses. Radius, the largest association by units in Northern Ireland, had a rise of 46 per cent to £9.1m.

Co-Ownership, which provides only shared ownership housing, saw its pre-tax surplus rise 84 per cent to £6m, largely thanks to a £3m rise in turnover.

Future

2019 was the penultimate year of the four-year rent cut programme in England. The surplus from social rent dropped again in 2019 by six per cent, which follows a smaller fall in the previous year.

Landlords are now in the midst of the final year of rent reductions and freezes to working-age benefits, so the question is what impact a further year of cuts will have on their finances.

Additionally, Universal Credit continues to be rolled out. The worries about Universal Credit centre on arrears caused by the five-week wait for the first payment and delays in arranging payment directly to the landlord for tenants who are struggling to pay. So landlords face another year of financial challenges in 2019/20 until rents rise in the following financial year.

Mr Johnson said that associations will have built the rent cut into their plans.

But he added: “There are greater headwinds facing the sector that were not there in the first two years of the rent settlement. Then there was a more buoyant housing market and there are now rising property costs [related to fire safety work] and Universal Credit. So they combine to create a downward pressure on the surplus.”

Notes and definitions for tables

Mixed-business groups = groups containing both stock transfer and traditional HAs

Operating surplus/turnover = operating costs plus costs of sales as a percentage of turnover

Total assets = fixed assets plus current assets

Debt per unit = total loans, bonds, finance leases (over a year) and intercompany debt (over a year) divided by units

In England, EBITDA MRI interest cover and gearing are taken from the RSH’s value for money metrics in each HA’s accounts. In Wales, Scotland and Northern Ireland they have been calculated as follows: gearing = debt/net book value of housing

HAs with LSVT-type finance will usually have planned high levels of debt relative to assets including mixed groups with a significant LSVT presence

EBITDA MRI interest cover = (operating surplus - surplus on sales of fixed assets - amortised government grants - government grants taken to income) + interest receivable + total depreciation charge for period - capitalised major repairs and improvements/capitalised interest + interest payable

HAs carrying properties at valuation will not have any amortised grant

*Sanctuary was the only association to adopt EU IFRS rather than FRS 102. In England its gearing and EBITDA MRI interest cover figures are taken from its accounts. We have not calculated them for Sanctuary Scotland

Source of data: audited accounts for year ended March 2019, except (†) = December 2018.

Additional data research by Stefan James and Romana Lisica

RELATED