Special report: the 2021 English Housing Revenue Accounts in detail

In the latest in Social Housing’s series of special reports on councils’ Housing Revenue Accounts, Savills’ Steve Partridge finds that the sector is continuing on its trajectory of increasing investment in housing post-debt cap

The first year of rent increases following the four-year rent cut saw local authorities continuing to expand investment in housing despite the pandemic, while there remains significant additional financial capacity for further investment, our analysis of the Housing Revenue Account (HRA) 2020-21 finances shows.

This is the fourth full year of our analysis, which now brings together five years of data, allowing us to further measure movements over time.

Our analysis shows a sector that has continued on a path towards increased investment in housing following the abolition of the HRA debt cap in October 2018. This is the third year that borrowing increased, and the 2020-21 financial year saw the biggest per-unit debt increase since the self-financing reforms of a decade ago.

While debt increased, so did capacity, and as rents increased, operating margins stabilised and interest cover strengthened slightly.

The overall picture is one of steady and proportionate investment matching growth in net income, net interest rate reductions, and slowing stock loss, and represents a positive story given the obvious pressures of the pandemic during 2020-21.

The national position for 2020-21

The key headlines support a conclusion that as rents were increased as the sector emerged from the rent cut period concluding 2020, authorities continued the upward trajectory of investment, drawing on the latent capacity within the sector but not at the expense of reducing that capacity going forward.

While borrowing increased, so did capacity – and as in previous years, all of the main metrics continue to support a case for additional investment.

As a result of severe delays in the publication of financial statements caused by the pandemic and other pressures on authorities, our analysis this year is limited by the absence (at the time of writing) of accounts for a number of authorities.

As all authorities will be going through their budgeting and planning cycles at this time, we thought it timely to present this analysis – however, due to the absence of this volume of authorities reporting, we have focused on proportionate and unit changes between years, particularly between 2019-20 and 2020-21. Where possible, we have acquired access to draft final accounts figures through direct approaches to authorities.

In overall terms, therefore, our analysis incorporates the following: of 162 HRA authorities, the accounts of 12 are unavailable in any form. We continue to exclude Salford and Oldham as PFI-only HRAs as these tend to distort the analysis.

The cohort of councils in our analysis represents 94 per cent of the stock held in the sector – hence we are confident that the year-on-year movements represent true trends in the sector. Therefore, all movements are quoted relating to the 150 authorities in our analysis.

Net property numbers reduced by 0.32 per cent, a further slowing of stock loss (0.35 per cent between 2018-19 and 2019-20) – this is the lowest reduction in HRA stock nationally since 2012, which saw the extension of discounts for the Right to Buy.

While this was of course driven in part by Right to Buy sales slowing during the early part of pandemic, the net position almost certainly comprises a reasonable addition to the stock from new developments.

Turnover increased around 0.7 per cent in 2020-21, the first year of increased overall income since 2016. While rent increases were allowed up to 2.7 per cent, there were evidently some reductions in income from non-rent sources during the year.

This may have been expected as a result of service costs and charges and reductions in non-dwellings rents during the pandemic.

Rents increased for our cohort by just over 3.5 per cent, suggesting some impact from the addition of new homes.

Operating costs, in which we continue to include provision via depreciation for major repairs expenditure, rose by just under 0.5 per cent. Clearly there will be many local factors at play, but this relatively lower cost increase may be as a result of reduced repairs and service costs during the pandemic, and is likely to be mirrored by the overall turnover increase being lower than the average rent increase.

The combination of changes in turnover and operating costs had the effect of stabilising operating margins between 2019-20 and 2020-21 – 22.1 per cent to 22.2 per cent. Margins remain somewhat tighter than might be seen within the housing association sector but continue to maintain healthy surpluses overall. Although it is not shown in the table, we estimate that revenue reserves rose up to three per cent between 31 March 2020 and 31 March 2021.

Following a year of relatively little movement in debt levels in 2018-19, but a net borrowing increase of 1.7 per cent in 2019-20, debt levels rose 1.9 per cent in 2020-21, a per-unit increase of 2.23 per cent in 2020-21.

Year on year, this is the biggest net increase in debt since the 2012 settlement and clearly shows that in the first two years post-debt cap, many authorities have begun, and continued, to bring forward investment programmes. Overall levels of debt remain well below equivalent levels in the housing association sector – the average for our cohort is less than £17,000 per unit, substantially below the £30,939 per social housing unit quoted in the Global Accounts for 2020-21.

Local authorities with HRAs (as at 31 March 2021)

| Local authority | Region | Number of units | Asset value per unit (£) | Debt (£000) | Debt per unit (£) | Turnover (£000) | Operating costs (£000) | Operating surplus (£000) | Operating margin | Interest cover ratio | Debt to turnover ratio |

Adur | SE | 2,537 | 83,570 | 61,591 | 24,277 | 13,420 | 11,161 | 2,259 | 16.83% | 1.03 | 4.59 |

Arun | SE | 3,384 | 71,604 | 52,973 | 15,654 | 16,541 | 12,012 | 4,529 | 27.38% | 3.19 | 3.20 |

Ashfield | EM | 6,635 | 34,922 | 80,061 | 12,066 | 24,424 | 15,323 | 9,101 | 37.26% | 2.57 | 3.28 |

Ashford | SE | 5,095 | 70,547 | 132,681 | 26,041 | 25,888 | 18,064 | 7,824 | 30.22% | 2.09 | 5.13 |

Babergh | East | 3,410 | 80,129 | 89,306 | 26,189 | 17,283 | 10,515 | 6,768 | 39.16% | 2.41 | 5.17 |

Barking & Dagenham | Lon | * | * | * | * | * | * | * | * | * | * |

Barnet | Lon | 9,694 | 92,324 | 203,644 | 21,007 | 63,159 | 59,434 | 3,725 | 5.90% | 0.49 | 3.22 |

Barnsley | YH | 18,264 | 36,825 | 271,734 | 14,878 | 72,493 | 55,691 | 16,802 | 23.18% | 1.60 | 3.75 |

Barrow-in-Furness | NW | 2,562 | 28,631 | 17,207 | 6,716 | 11,248 | 8,091 | 3,157 | 28.07% | 3.66 | 1.53 |

Basildon | East | 10,789 | 84,094 | 205,042 | 19,005 | 54,111 | 44,566 | 9,545 | 17.64% | 1.13 | 3.79 |

Bassetlaw | EM | 6,638 | 45,138 | 92,141 | 13,881 | 27,030 | 19,186 | 7,844 | 29.02% | 2.12 | 3.41 |

Birmingham | WM | 59,710 | 44,185 | 1,048,007 | 17,552 | 282,200 | 188,100 | 94,100 | 33.35% | 2.01 | 3.71 |

Blackpool | NW | 4,741 | 27,603 | 4,849 | 1,023 | 19,515 | 14,532 | 4,983 | 25.53% | 14.61 | 0.25 |

Bolsover | EM | 5,030 | 46,394 | 109,135 | 21,697 | 21,324 | 18,155 | 3,169 | 14.86% | 0.81 | 5.12 |

BCP | SW | 9,596 | 66,125 | 137,210 | 14,299 | 45,593 | 34,899 | 10,694 | 23.46% | 1.94 | 3.01 |

Brent | Lon | 7,912 | 85,402 | 243,430 | 30,767 | 56,500 | 41,800 | 14,700 | 26.02% | 2.16 | 4.31 |

Brentwood | East | 2,475 | 115,331 | 63,437 | 25,631 | 13,185 | 8,529 | 4,656 | 35.31% | 2.38 | 4.81 |

Brighton & Hove | SE | 11,695 | 80,283 | 148,852 | 12,728 | 61,308 | 48,588 | 12,720 | 20.75% | 2.40 | 2.43 |

Bristol | SW | 26,767 | 68,717 | 244,568 | 9,137 | 123,136 | 103,292 | 19,844 | 16.12% | 1.77 | 1.99 |

Broxtowe | EM | 4,403 | 43,385 | 81,435 | 18,495 | 16,359 | 12,935 | 3,424 | 20.93% | 1.44 | 4.98 |

Bury | NW | 7,865 | 31,928 | 118,784 | 15,103 | 31,073 | 23,216 | 7,857 | 25.29% | 1.69 | 3.82 |

Cambridge | East | 7,150 | 98,753 | 205,835 | 28,788 | 42,904 | 28,296 | 14,608 | 34.05% | 1.95 | 4.80 |

Camden | Lon | 22,960 | 114,684 | 491,327 | 21,399 | 192,721 | 169,100 | 23,621 | 12.26% | 1.65 | 2.55 |

Cannock Chase | WM | 5,066 | 42,660 | 82,494 | 16,284 | 20,064 | 13,890 | 6,174 | 30.77% | 1.90 | 4.11 |

Canterbury | SE | 5,078 | 68,861 | 75,815 | 14,930 | 25,598 | 19,854 | 5,744 | 22.44% | 2.81 | 2.96 |

Castle Point | East | 1,510 | 86,237 | 36,571 | 24,219 | 7,747 | 6,094 | 1,653 | 21.34% | 1.64 | 4.72 |

Central Bedfordshire | East | 5,377 | 92,695 | 205,378 | 38,196 | 31,490 | 24,414 | 7,076 | 22.47% | 1.54 | 6.52 |

Charnwood | EM | 5,545 | 57,120 | 81,572 | 14,711 | 21,817 | 15,972 | 5,845 | 26.79% | 2.16 | 3.74 |

Cheltenham | SW | 4,500 | 58,837 | 61,289 | 13,620 | 20,514 | 17,355 | 3,159 | 15.40% | 1.76 | 2.99 |

Cheshire West and Chester | NW | 5,462 | 38,545 | 92,092 | 16,860 | 22,720 | 13,838 | 8,882 | 39.09% | 3.99 | 4.05 |

Chesterfield | EM | 8,972 | 41,883 | 126,477 | 14,097 | 37,180 | 31,195 | 5,985 | 16.10% | 1.30 | 3.40 |

City of London | Lon | 1,867 | 131,334 | 0 | 0 | 14,800 | 15,400 | -600 | -4.05% | - | - |

Colchester | East | 5,905 | 67,201 | 127,933 | 21,665 | 29,884 | 19,942 | 9,942 | 33.27% | 2.21 | 4.28 |

Corby | EM | * | * | * | * | * | * | * | * | * | * |

Cornwall | SW | 10,207 | 59,034 | 123,778 | 12,127 | 40,861 | 33,010 | 7,851 | 19.21% | 2.35 | 3.03 |

Crawley | SE | 8,242 | 87,970 | 260,325 | 31,585 | 50,086 | 26,078 | 24,008 | 47.93% | 2.89 | 5.20 |

Croydon | Lon | 13,393 | 76,658 | 353,965 | 26,429 | 88,492 | 64,922 | 23,570 | 26.64% | 1.95 | 4.00 |

Dacorum | East | 10,140 | 109,078 | 335,928 | 33,129 | 54,353 | 33,678 | 20,675 | 38.04% | 1.80 | 6.18 |

Darlington | NE | 5,289 | 32,422 | 68,967 | 13,040 | 24,395 | 16,343 | 8,052 | 33.01% | 3.36 | 2.83 |

Dartford | SE | 4,245 | 77,329 | 46,964 | 11,063 | 21,753 | 12,652 | 9,101 | 41.84% | 7.32 | 2.16 |

Derby | EM | 12,659 | 42,884 | 214,819 | 16,970 | 58,728 | 50,533 | 8,195 | 13.95% | 0.80 | 3.66 |

Doncaster | YH | 20,080 | 33,978 | 267,428 | 13,318 | 76,411 | 55,162 | 21,249 | 27.81% | 1.72 | 3.50 |

Dover | SE | 4,325 | 63,876 | 59,482 | 13,753 | 20,233 | 12,628 | 7,605 | 37.59% | 3.00 | 2.94 |

Dudley | WM | 21,397 | 44,011 | 470,233 | 21,977 | 90,115 | 72,150 | 17,965 | 19.94% | 1.04 | 5.22 |

Ealing | Lon | 11,700 | 80,483 | 164,644 | 14,072 | 64,761 | 52,542 | 12,219 | 18.87% | 1.59 | 2.54 |

East Devon | SW | 4,170 | 60,472 | 83,062 | 19,919 | 18,366 | 9,861 | 8,505 | 46.31% | 3.31 | 4.52 |

East Riding of Yorkshire | YH | 11,487 | 42,707 | 245,398 | 21,363 | 49,786 | 31,394 | 18,392 | 36.94% | 2.40 | 4.93 |

Eastbourne | SE | 3,376 | 62,327 | 42,727 | 12,656 | 15,768 | 14,268 | 1,500 | 9.51% | 0.94 | 2.71 |

Enfield | Lon | 10,494 | 76,838 | 240,173 | 22,887 | 66,901 | 51,346 | 15,555 | 23.25% | 1.79 | 3.59 |

Epping Forest | East | 6,437 | 114,069 | 157,552 | 24,476 | 34,429 | 26,439 | 7,990 | 23.21% | 1.48 | 4.58 |

Exeter | SW | 4,837 | 58,305 | 66,002 | 13,645 | 19,933 | 15,280 | 4,653 | 23.34% | 1.99 | 3.31 |

Fareham | SE | 2,395 | 56,271 | 51,823 | 21,638 | 12,573 | 8,890 | 3,683 | 29.29% | 2.02 | 4.12 |

Gateshead | NE | 18,802 | 38,300 | 345,505 | 18,376 | 78,312 | 62,605 | 15,707 | 20.06% | 1.25 | 4.41 |

Gosport | SE | 3,104 | 49,355 | 61,565 | 19,834 | 14,989 | 12,981 | 2,008 | 13.40% | 1.09 | 4.11 |

Gravesham | SE | * | * | * | * | * | * | * | * | * | * |

Great Yarmouth | East | 5,787 | 45,167 | 88,260 | 15,251 | 23,338 | 17,620 | 5,718 | 24.50% | 2.12 | 3.78 |

Greenwich | Lon | 20,950 | 72,449 | 334,630 | 15,973 | 121,388 | 104,444 | 16,944 | 13.96% | 1.14 | 2.76 |

Guildford | SE | 5,228 | 102,551 | 197,024 | 37,686 | 32,189 | 17,198 | 14,991 | 46.57% | 3.06 | 6.12 |

Hackney | Lon | 21,706 | 111,678 | 130,541 | 6,014 | 145,044 | 135,398 | 9,646 | 6.65% | 6.24 | 0.90 |

Hammersmith & Fulham | Lon | 12,096 | 122,647 | 233,046 | 19,266 | 80,734 | 79,500 | 1,234 | 1.53% | 0.14 | 2.89 |

Haringey | Lon | 15,287 | 97,896 | 285,526 | 18,678 | 103,071 | 80,868 | 22,203 | 21.54% | 2.07 | 2.77 |

Harlow | East | 9,158 | 82,688 | 196,269 | 21,431 | 48,391 | 36,258 | 12,133 | 25.07% | 1.75 | 4.06 |

Harrogate | YH | 3,876 | 64,692 | 61,189 | 15,787 | 17,728 | 8,512 | 9,216 | 51.99% | 5.72 | 3.45 |

Harrow | Lon | 4,744 | 106,163 | 150,683 | 31,763 | 32,089 | 25,830 | 6,259 | 19.51% | 0.97 | 4.70 |

Havering | Lon | 9,325 | 75,187 | 215,276 | 23,086 | 60,459 | 39,958 | 20,501 | 33.91% | 3.21 | 3.56 |

High Peak | EM | 3,889 | 46,819 | 55,859 | 14,363 | 15,145 | 9,668 | 5,477 | 36.16% | 3.06 | 3.69 |

Hillingdon | Lon | 10,198 | 79,944 | 173,394 | 17,003 | 63,678 | 38,463 | 25,215 | 39.60% | 3.92 | 2.72 |

Hinckley & Bosworth | EM | 3,219 | 60,185 | 71,915 | 22,341 | 14,459 | 9,537 | 4,922 | 34.04% | 2.43 | 4.97 |

Hounslow | Lon | 12,929 | 87,640 | 251,407 | 19,445 | 90,600 | 69,000 | 21,600 | 23.84% | 2.32 | 2.77 |

Ipswich | East | 7,876 | 58,327 | 112,906 | 14,335 | 35,353 | 26,289 | 9,064 | 25.64% | 2.58 | 3.19 |

Islington | Lon | 25,299 | 136,187 | 442,261 | 17,481 | 201,139 | 165,731 | 35,408 | 17.60% | 1.70 | 2.20 |

Kensington & Chelsea | Lon | 6,691 | 124,422 | 210,617 | 31,478 | 55,200 | 52,185 | 3,015 | 5.46% | 0.38 | 3.82 |

Kettering | EM | 3,603 | 52,012 | 51,647 | 14,334 | 15,234 | 10,571 | 4,663 | 30.61% | 2.49 | 3.39 |

Kingston upon Hull | YH | 23,467 | 27,992 | 209,200 | 8,915 | 95,228 | 73,591 | 21,637 | 22.72% | 2.39 | 2.20 |

Kingston upon Thames | Lon | 4,569 | 89,938 | 131,509 | 28,783 | 30,845 | 28,658 | 2,187 | 7.09% | 0.47 | 4.26 |

Kirklees | YH | 22,137 | 33,339 | 218,387 | 9,865 | 82,118 | 67,606 | 14,512 | 17.67% | 1.20 | 2.66 |

Lambeth | Lon | 23,936 | 100,254 | 384,965 | 16,083 | 162,887 | 143,896 | 18,991 | 11.66% | 0.83 | 2.36 |

Lancaster | NW | 3,660 | 36,266 | 37,227 | 10,171 | 15,461 | 12,135 | 3,326 | 21.51% | 1.81 | 2.41 |

Leeds | YH | 54,281 | 42,776 | 818,598 | 15,081 | 222,124 | 157,969 | 64,155 | 28.88% | 1.71 | 3.69 |

Leicester | EM | 20,066 | 53,972 | 237,881 | 11,855 | 79,887 | 67,508 | 12,379 | 15.50% | 1.40 | 2.98 |

Lewes | SE | * | * | * | * | * | * | * | * | * | * |

Lewisham | Lon | 13,762 | 103,864 | 55,500 | 4,033 | 86,404 | 75,422 | 10,982 | 12.71% | 2.89 | 0.64 |

Lincoln | EM | 7,768 | 38,828 | 70,273 | 9,046 | 29,076 | 23,074 | 6,002 | 20.64% | 2.47 | 2.42 |

Luton | East | 7,784 | 62,952 | 134,090 | 17,226 | 40,046 | 30,324 | 9,722 | 24.28% | 2.06 | 3.35 |

Manchester | NW | 15,620 | 41,649 | 299,237 | 19,157 | 63,260 | 50,209 | 13,051 | 20.63% | 1.15 | 4.73 |

Mansfield | EM | 6,444 | 36,551 | 70,437 | 10,931 | 27,390 | 20,143 | 7,247 | 26.46% | 2.69 | 2.57 |

Medway | SE | 3,005 | 53,310 | 40,987 | 13,640 | 14,049 | 10,792 | 3,257 | 23.18% | 1.58 | 2.92 |

Melton | EM | 1,802 | 55,399 | 31,484 | 17,472 | 7,591 | 6,165 | 1,426 | 18.79% | 1.22 | 4.15 |

Mid Devon | SW | 2,995 | 52,832 | 39,550 | 13,205 | 13,274 | 9,081 | 4,193 | 31.59% | 3.92 | 2.98 |

Mid Suffolk | East | 3,225 | 78,252 | 88,763 | 27,523 | 15,380 | 10,534 | 4,846 | 31.51% | 1.83 | 5.77 |

Milton Keynes | SE | 11,148 | 65,826 | 241,288 | 21,644 | 57,357 | 42,137 | 15,220 | 26.54% | 2.25 | 4.21 |

New Forest | SE | 5,168 | 74,717 | 132,301 | 25,600 | 28,097 | 20,909 | 7,188 | 25.58% | 1.62 | 4.71 |

Newark & Sherwood | EM | 5,506 | 56,899 | 109,024 | 19,801 | 24,348 | 15,346 | 9,002 | 36.97% | 2.11 | 4.48 |

Newcastle upon Tyne | NE | 25,085 | 36,278 | 376,572 | 15,012 | 111,147 | 91,948 | 19,199 | 17.27% | 1.13 | 3.39 |

Newham | Lon | 15,930 | 87,455 | 199,573 | 12,528 | 99,699 | 87,869 | 11,830 | 11.87% | 0.85 | 2.00 |

North East Derbyshire | EM | 7,618 | 48,630 | 169,800 | 22,289 | 31,320 | 20,457 | 10,863 | 34.68% | 2.19 | 5.42 |

North Kesteven | EM | 3,845 | 43,693 | 64,966 | 16,896 | 15,664 | 13,562 | 2,102 | 13.42% | 1.09 | 4.15 |

North Tyneside | NE | 14,441 | 45,922 | 313,049 | 21,678 | 62,605 | 35,548 | 27,057 | 43.22% | 1.85 | 5.00 |

North Warwickshire | WM | * | * | * | * | * | * | * | * | * | * |

North West Leicestershire | EM | 4,184 | 64,031 | 70,608 | 16,876 | 17,949 | 10,984 | 6,965 | 38.80% | 3.18 | 3.93 |

Northampton | EM | * | * | * | * | * | * | * | * | * | * |

Northumberland | YH | 8,426 | 40,084 | 104,871 | 12,446 | 32,757 | 29,460 | 3,297 | 10.07% | 1.34 | 3.20 |

Norwich | East | 14,533 | 57,354 | 207,516 | 14,279 | 68,091 | 49,645 | 18,446 | 27.09% | 2.30 | 3.05 |

Nottingham | EM | 25,328 | 46,500 | 298,047 | 11,767 | 108,899 | 73,972 | 34,927 | 32.07% | 2.41 | 2.74 |

Nuneaton & Bedworth | WM | 5,707 | 40,572 | 79,110 | 13,862 | 25,884 | 23,220 | 2,664 | 10.29% | 1.38 | 3.06 |

Oadby & Wigston | EM | 1,199 | 56,143 | 19,733 | 16,458 | 5,040 | 4,315 | 725 | 14.38% | 1.36 | 3.92 |

Oxford | SE | 7,682 | 92,675 | 240,374 | 31,291 | 45,581 | 30,419 | 15,162 | 33.26% | 1.97 | 5.27 |

Portsmouth | SE | 14,653 | 48,706 | 196,163 | 13,387 | 84,356 | 78,237 | 6,119 | 7.25% | 1.04 | 2.33 |

Reading | SE | * | * | * | * | * | * | * | * | * | * |

Redbridge | Lon | 4,498 | 82,240 | 81,460 | 18,110 | 29,409 | 21,552 | 7,857 | 26.72% | 3.07 | 2.77 |

Redditch | WM | * | * | * | * | * | * | * | * | * | * |

Richmondshire | YH | 1,492 | 46,523 | 16,158 | 10,830 | 6,459 | 5,234 | 1,225 | 18.97% | 3.06 | 2.50 |

Rotherham | YH | 20,195 | 36,653 | 305,871 | 15,146 | 83,756 | 60,348 | 23,408 | 27.95% | 1.76 | 3.65 |

Rugby | WM | 3,686 | 55,145 | 64,332 | 17,453 | 16,521 | 13,521 | 3,000 | 18.16% | 1.33 | 3.89 |

Runnymede | SE | 2,878 | 106,738 | 101,956 | 35,426 | 17,217 | 8,304 | 8,913 | 51.77% | 2.56 | 5.92 |

Sandwell | WM | 28,412 | 41,662 | 443,420 | 15,607 | 121,294 | 83,090 | 38,204 | 31.50% | 2.13 | 3.66 |

Sedgemoor | SW | 4,044 | 44,897 | 58,975 | 14,583 | 18,232 | 12,565 | 5,667 | 31.08% | 3.68 | 3.23 |

Selby | YH | 3,017 | 54,493 | 49,542 | 16,421 | 12,855 | 6,730 | 6,125 | 47.65% | 3.20 | 3.85 |

Sheffield | YH | 38,877 | 42,156 | 345,914 | 8,898 | 152,364 | 114,939 | 37,425 | 24.56% | 2.89 | 2.27 |

Shepway | SE | 3,388 | 56,872 | 47,417 | 13,996 | 16,324 | 12,162 | 4,162 | 25.50% | 2.69 | 2.90 |

Shropshire | WM | 4,042 | 51,138 | 84,859 | 20,994 | 18,418 | 13,903 | 4,515 | 24.51% | 1.51 | 4.61 |

Slough | SE | * | * | * | * | * | * | * | * | * | * |

Solihull | WM | 9,859 | 48,295 | 172,138 | 17,460 | 44,418 | 33,521 | 10,897 | 24.53% | 1.51 | 3.88 |

South Cambridgeshire | East | 5,469 | 94,166 | 205,123 | 37,506 | 30,299 | 17,087 | 13,212 | 43.61% | 1.84 | 6.77 |

South Derbyshire | EM | 2,974 | 44,645 | 61,584 | 20,707 | 12,541 | 10,558 | 1,983 | 15.81% | 1.29 | 4.91 |

South Holland | EM | 3,793 | 47,305 | 68,427 | 18,040 | 16,274 | 10,641 | 5,633 | 34.61% | 2.40 | 4.20 |

South Kesteven | EM | 5,914 | 45,974 | 96,404 | 16,301 | 25,026 | 16,344 | 8,682 | 34.69% | 3.43 | 3.85 |

South Tyneside | NE | 16,384 | 35,990 | 287,503 | 17,548 | 65,505 | 53,417 | 12,088 | 18.45% | 1.13 | 4.39 |

Southampton | SE | 15,847 | 46,691 | 164,334 | 10,370 | 76,575 | 68,491 | 8,084 | 10.56% | 1.69 | 2.15 |

Southend-on-Sea | East | 6,034 | 69,891 | 99,090 | 16,422 | 28,204 | 20,648 | 7,556 | 26.79% | 2.34 | 3.51 |

Southwark | Lon | 36,918 | 96,108 | 504,931 | 13,677 | 268,726 | 233,144 | 35,582 | 13.24% | 1.55 | 1.88 |

St Albans | East | 4,958 | 129,857 | 149,385 | 30,130 | 28,628 | 20,103 | 8,525 | 29.78% | 1.83 | 5.22 |

Stevenage | East | 7,974 | 84,173 | 232,597 | 29,169 | 43,761 | 34,019 | 9,742 | 22.26% | 1.41 | 5.32 |

Stockport | NW | 11,055 | 50,980 | 150,964 | 13,656 | 54,791 | 49,481 | 5,310 | 9.69% | 0.90 | 2.76 |

Stoke-on-Trent | WM | 17,705 | 36,025 | 164,146 | 9,271 | 65,952 | 59,784 | 6,168 | 9.35% | 0.94 | 2.49 |

Stroud | SW | 4,992 | 56,706 | 96,128 | 19,256 | 22,922 | 17,135 | 5,787 | 25.25% | 1.71 | 4.19 |

Sutton | Lon | 6,014 | 73,311 | 203,491 | 33,836 | 38,197 | 25,974 | 12,223 | 32.00% | 1.74 | 5.33 |

Swindon | SW | 10,264 | 47,569 | 99,016 | 9,647 | 51,157 | 35,565 | 15,592 | 30.48% | 4.52 | 1.94 |

Tamworth | WM | 4,341 | 46,452 | 69,893 | 16,101 | 21,086 | 14,126 | 6,960 | 33.01% | 2.61 | 3.31 |

Tandridge | SE | 2,586 | 131,623 | 61,308 | 23,708 | 14,980 | 21,020 | -6,040 | -40.32% | -3.64 | 4.09 |

Taunton Deane | SW | 5,701 | 57,058 | 109,718 | 19,245 | 31,285 | 23,282 | 8,003 | 25.58% | 3.28 | 3.51 |

Tendring | East | 3,100 | 73,107 | 38,442 | 12,401 | 13,412 | 11,409 | 2,003 | 14.93% | 1.47 | 2.87 |

Thanet | SE | 3,061 | 56,409 | 28,237 | 9,225 | 14,447 | 13,652 | 795 | 5.50% | 1.21 | 1.95 |

Thurrock | East | 9,840 | 78,671 | 195,263 | 19,844 | 55,448 | 48,118 | 7,330 | 13.22% | 1.29 | 3.52 |

Tower Hamlets | Lon | 11,632 | 102,450 | 133,279 | 11,458 | 97,655 | 95,032 | 2,623 | 2.69% | 0.59 | 1.36 |

Uttlesford | East | 2,801 | 114,135 | 82,789 | 29,557 | 16,138 | 10,271 | 5,867 | 36.36% | 2.18 | 5.13 |

Waltham Forest | Lon | 10,001 | 99,827 | 200,631 | 20,061 | 61,858 | 49,707 | 12,151 | 19.64% | 1.29 | 3.24 |

Wandsworth | Lon | 17,299 | 93,054 | 237,081 | 13,705 | 147,022 | 109,500 | 37,522 | 25.52% | 11.50 | 1.61 |

Warwick | WM | 5,462 | 82,693 | 162,088 | 29,676 | 28,743 | 19,207 | 9,536 | 33.18% | 2.00 | 5.64 |

Waveney | East | 4,459 | 51,468 | 77,377 | 17,353 | 21,113 | 13,925 | 7,188 | 34.05% | 3.30 | 3.66 |

Waverley | SE | 4,848 | 97,204 | 176,475 | 36,402 | 29,690 | 15,298 | 14,392 | 48.47% | 2.58 | 5.94 |

Wealden | SE | 3,005 | 75,023 | 70,271 | 23,385 | 15,272 | 10,620 | 4,652 | 30.46% | 2.62 | 4.60 |

Welwyn Hatfield | East | 9,012 | 115,342 | 241,127 | 26,756 | 52,059 | 37,090 | 14,969 | 28.75% | 2.46 | 4.63 |

West Lancashire | NW | * | * | * | * | * | * | * | * | * | * |

Westminster | Lon | 11,889 | 139,570 | 293,835 | 24,715 | 113,386 | 98,414 | 14,972 | 13.20% | 1.60 | 2.59 |

Wigan | NW | 21,575 | 29,426 | 314,969 | 14,599 | 88,261 | 73,376 | 14,885 | 16.86% | 1.10 | 3.57 |

Wiltshire | SW | * | * | * | * | * | * | * | * | * | * |

Winchester | SE | 5,102 | 94,910 | 178,177 | 34,923 | 29,155 | 21,759 | 7,396 | 25.37% | 1.43 | 6.11 |

Woking | SE | 3,338 | 92,377 | 149,137 | 44,678 | 18,062 | 12,229 | 5,833 | 32.29% | 1.13 | 8.26 |

Wokingham | SE | * | * | * | * | * | * | * | * | * | * |

Wolverhampton | WM | 21,808 | 39,706 | 264,900 | 12,147 | 95,100 | 67,300 | 27,800 | 29.23% | 2.75 | 2.79 |

York | YH | 7,581 | 70,755 | 146,359 | 19,306 | 34,850 | 26,532 | 8,318 | 23.87% | 1.91 | 4.20 |

Total |

| 1,491,332 | 64,618 | 25,193,264 | 16,893 | 7,688,374 | 5,978,493 | 1,709,881 | 22.24% | 1.82 | 3.45 |

Note: *Accounts were not available for these local authorities

By contrast, asset valuations again increased significantly during the year – unit valuations increased by as much as five per cent nationally in 2020-21. These valuations no doubt reflect wider movements in house prices during the first year of the pandemic. As we have discussed at length before in these analyses, while asset values are not directly linked to the ability to borrow, and the continued unsuitability of the methodology used to value assets in the HRA, the fact that loan-to-value ratios across the sector as a whole decreased in 2020-21 provides additional evidence that the sector is under-leveraged.

Key debt metrics

The interest cover ratio (measured as operating surpluses after taking into account major repairs financed from revenue via depreciation) increased from 1.75 to 1.82 for our cohort of authorities; the national figure for 2019-20 was actually 1.67. This represented a stabilisation of investment capacity driven by a stabilisation of operating margins and a slight reduction in net interest rates from 3.9 per cent to 3.6 per cent between the years. It is likely that new borrowing at lower rates, combined with repayment of higher-rate debt by some authorities, will have contributed to this average reduction in the cost of capital.

At the national level, interest cover remains well above the ‘golden rule’ of 1.25 adopted by many authorities following the abolition of the debt cap.

It is important to remember that a significant level of capital expenditure towards the existing stock has been accounted for as operating cost within this metric (as a result of the depreciation mechanism in the HRA). Authorities are able to borrow with the confidence that their main life cycle repair costs are already covered through rent income.

Loan-to-value ratios reduced slightly from 27 per cent to 26 per cent as asset valuation strengthened at a higher rate than borrowing. This continues to represent a very low result compared to housing associations and one that strongly suggests that a review of the current regional-based valuation methodology is long overdue – as we have reported before, it is simply no longer fit for purpose for a post-debt cap HRA.

Debt-to-turnover ratios increased from 3.24 to 3.45. The lower growth in turnover compared to dwelling rental growth has affected this metric but it remains in line with the housing association sector equivalent.

The national position over time

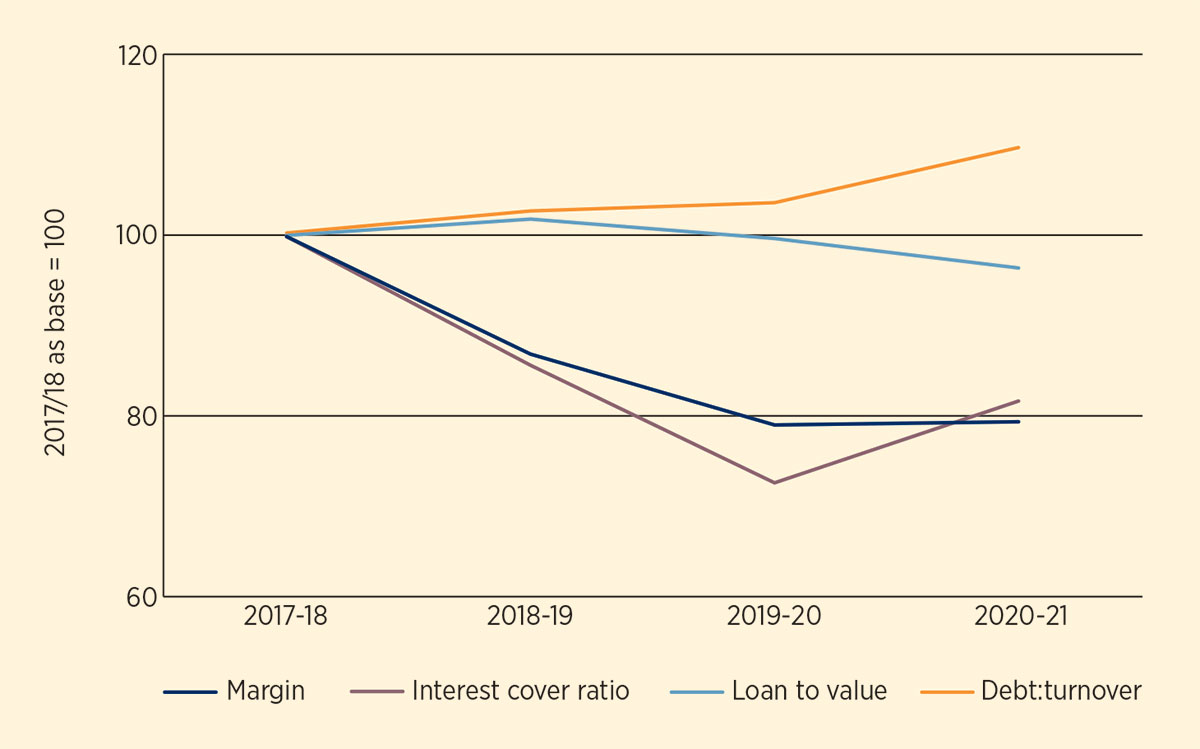

We have now undertaken this analysis for four full financial years from 2017 to 2021 and some key trends over time continue to emerge, albeit that the end of the debt cap and the end of the rent cut period remain significant milestones.

Property numbers have reduced by a net 1.4 per cent between 2017-18 and 2020-21 while turnover has reduced 2.3 per cent and operating costs have risen 4.9 per cent. Debt is up 5.3 per cent per unit over the four years. Behind these consolidated movements is a more nuanced story.

The changes in turnover and operating costs were actually more pronounced between 2017-18 and 2018-19 – a period when spending decisions were taken before the announcement of the removal of the debt cap and the sector was still in the throes of the rent cut, and the focus of authorities was to manage risk driven by reducing income.

Last year, in the first full year post-debt cap, we reported that the reduction in turnover slowed, as did the increase in operating costs, with borrowing for investment beginning to increase. Despite issues relating to the change in non-rent income (perhaps as a result of the pandemic) in 2020-21, the second full year post-debt cap saw a continued increase in borrowing with a stabilised operating margin and interest cover.

Hence, as the chart shows, there is a very real sense in which the retrenchment brought on by the rent cut period, together with the abolition of the debt cap, is now over. While some authorities continue to prioritise debt reduction nearly 10 years on from the self-financing settlement, the majority experience the opposite: further responding to the incentive to borrow to invest.

The regional position

Behind the national position lies significant variation at the authority level, and a look at the table showing the regional split for some key measures between 2019-20 and 2020-21 (below) offers further insight into the trends locally.

In contrast to changes in previous years, the movement in interest cover is relatively even and stable across all regions.

While London HRAs continue to offer a major contrast to the other regions, with higher rents, lower operating margins and the lowest interest cover of all regions, the change in debt, margin and interest cover is much closer to the national average than last year.

The South West, South East and East of England continue to offer significant capacity to invest with strongest interest cover across these three regions, averaging above 2.0 in 2020-21. Slight net increases across the Midlands and Northern regions were very similar, with average interest cover across these five regions at or around the national average.

The movement in operating margins also showed a remarkable consistency in movement between years across the regions, with small reductions in the North West, Yorkshire and the Humber and the South East contrasted

with small increases across London, the South West, the East of England, the North East and the Midlands. The strengthening of margins and interest cover in the East and the South West of England are higher than average and show strengthening investment capacity in those regions.

Perhaps the most variable comparable statistic between years remains property numbers. Clear signs of investment are seen in London and the South East with next to no net stock loss between years – a combination of reduced Right to Buys (driven by high values) and investment in new homes. This is supported by these two regions showing the highest increase in per-unit debt – well above the national average.

This contrasts with the East Midlands (in particular) where net stock losses arise from continued relatively high rates of Right to Buy sales – sales ran at up to one per cent in this region, despite the slowdown as a result of the pandemic.

Net additional borrowing in the Northern regions remains comparatively slow – debt levels are stable, perhaps indicating a lower delivery of net additional investment.

Regional totals for local authorities with HRAs (as at 31 March 2021)

| Regions | Number of units | Unit % change | Debt per unit (£) | Debt / unit change | Average rents (£) | Operating margin (2019-20) | Operating margin (2020-21) | Interest cover ratio (2019-20) | Interest cover ratio (2020-21) | Turnover per unit (£) | Operating costs per unit (£) | Operating surplus per unit (£) |

| London | 373,693 | -0.09% | 17,530 | 4.87% | 108.63 | 15.90% | 16.00% | 1.58 | 1.66 | 7,056 | 5,928 | 1,129 |

| East of England | 155,203 | -0.33% | 23,041 | 1.58% | 91.96 | 25.60% | 27.20% | 1.74 | 1.89 | 5,187 | 3,774 | 1,413 |

| South East | 144,413 | -0.06% | 20,914 | 3.41% | 93.71 | 26.70% | 24.80% | 2.15 | 2.04 | 5,342 | 4,019 | 1,323 |

| South West | 88,073 | -0.23% | 12,709 | 1.64% | 80.74 | 20.20% | 23.20% | 2.01 | 2.43 | 4,602 | 3,535 | 1,067 |

| East Midlands | 157,034 | -0.88% | 14,861 | 1.28% | 75.52 | 24.60% | 25.50% | 1.82 | 1.92 | 4,156 | 3,096 | 1,061 |

| West Midlands | 187,195 | -0.47% | 16,590 | 1.65% | 80.16 | 26.70% | 27.50% | 1.73 | 1.84 | 4,433 | 3,215 | 1,218 |

| Yorkshire and the Humber | 233,180 | -0.26% | 13,126 | -0.30% | 74.11 | 26.80% | 26.20% | 1.91 | 1.95 | 4,027 | 2,973 | 1,054 |

| North West | 72,540 | -0.40% | 14,273 | 0.26% | 76.02 | 22.90% | 20.10% | 1.63 | 1.51 | 4,223 | 3,376 | 847 |

| North East | 80,001 | -0.51% | 17,395 | -0.15% | 75.94 | 23.90% | 24.00% | 1.41 | 1.43 | 4,274 | 3,248 | 1,026 |

| Nationwide | 1,491,332 | -0.32% | 16,893 | 2.23% | 88.01 | 22.10% | 22.20% | 1.75 | 1.82 | 5,155 | 4,009 | 1,147 |

Unit operating costs position

Turnover per unit increased by one per cent between 2019-20 and 2020-21, while operating costs per unit have increased 0.7 per cent over the same period, resulting in a reduction in operating surpluses that remain around a fifth. Following a number of years of turnover reduction and operating cost increases, the overwhelming sense is of authorities stabilising their revenue finances in 2020-21. This provides a solid foundation to bring forward further investment in the next few years.

There remains considerable variation around the average unit turnover for our cohort of authorities of £5,155 – with London authorities remaining on average clear outliers with turnover per unit above £7,000 and the East and South East also both above the national average. The Midlands and Northern regions are again well below the national average, with Yorkshire and the Humber authorities showing comfortably the lowest turnover of all regions.

This continues to be matched by similar trends in unit operating costs, with the London authorities well above the national average of our cohort of £4,009 at more than £5,900 per unit.

Conversely, and reinforcing a trend from previous years, surpluses per unit were weaker in London than the national average, with the East, South East and West Midlands regions showing stronger surpluses this year.

Once again, net unit surpluses in Yorkshire and the Humber authorities were well below the national average, showing as much as a 10 per cent drop overall between 2019-20 and 2020-21. Such a trend in lower margins may well help to explain the relative lack of additional investment across the region.

It will be interesting to see how these unit income and expenditure measures compare to the housing association sector. With the impending change to more proactive regulation of local authorities, we might expect to see more focus on the way that authorities raise income and spend on services and on their stock.

While much of the focus of local authorities since 2018 has been around the capacity for investment, our analysis continues to provide a strong platform for beginning to understand more about the way local authorities spend on services and existing stock, and many may be looking at drawing on investment capacity for major investment in areas such as building safety and net zero carbon. We will be producing a more detailed regional and trend analysis in a future article.

Both unit turnover and operating costs for local authorities are well below those of housing associations. As proactive regulation proceeds, what might these spending patterns show about the way in which the consumer standards are delivered?

Summary

Our analysis of the 2020-21 finances shows a resilient sector that has emerged from the period of rent cuts and is proceeding, on balance, with plans for net growth. All the main metrics have stabilised or improved this year: authorities can look forward to being able to draw on growing capacity as income grows and investment proceeds.

As we have highlighted in each of the years of our analysis, the capacity for increased investment by local authorities remains strong and significant, on any key measure. And these measures continue to compare favourably to similar measures in the housing association sector.

We estimate that latent net borrowing capacity remains well above £10bn based on our golden rule minimum interest cover of 1.25. If taken at the individual authority level, capacity is likely to be greater, perhaps exceeding the £16bn we referenced last year and maybe even up to £20bn depending on how investment is deployed over the next five to 10 years – after all, building new homes delivers income-generating assets that increase capacity.

There are clear signs of a sector beginning to invest – for the second year in a row – a marked increase in borrowing, despite the pandemic.

Steve Partridge, director, Savills Housing Consultancy

RELATED