THFC’s Priya Nair on leveraging legacy and lessons from infrastructure to free up sector capacity

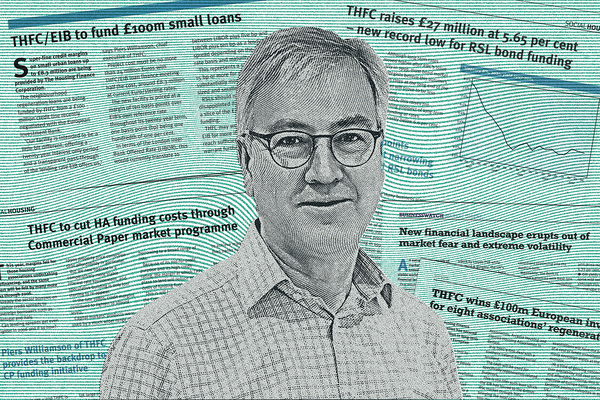

Priya Nair speaks to Sarah Williams about bringing lessons from infrastructure to her leadership of The Housing Finance Corporation, leaning in on legacy, and what the organisation’s new strategy means in practice

When it comes to setting a strategy for the future of The Housing Finance Corporation (THFC), the funding aggregator’s new chief executive has started by looking to the past.

“I want to ‘lean in’ on quite a bit of what I think are the pillars of our legacy,” Ms Nair tells Social Housing three months after launching a new strategy for the funder, which she joined in March this year.

Among these pillars are the organisation’s position as “adjacent” to government and its ability to help the sector access private capital, Ms Nair says. The aggregator’s total loan book is currently just shy of £8bn.

But in designing and delivering the refreshed strategy with her team, she is also drawing on her own professional history: a period of 27 years she describes as a “career of two halves”.

The first half saw Ms Nair provide strategic financial advice in private debt and equity, with the last 15 years of this focused on the infrastructure asset class.

“The latter is very relevant to this sector, which I see as a sub-sector of infrastructure,” she tells Social Housing.

The second half has been “much more as an investor-operator”, she says. “In that space, I was very focused on investing, scaling businesses, improving operational efficiency, driving growth – and sustainability was at the heart of that." Recent roles included senior director of infrastructure at Abrdn Investment Management.

“So I see it as two halves, and that, I think, brings interesting experience to this organisation, both strategically and operationally.”

Ms Nair is overseeing a new business plan for the provider that will include opening its offer to for-profits for the first time, an enhanced focus on smaller housing associations, and the creation of new financial solutions that bring together a range of participants in sustainability.

Plans unveiled include a partnership with the National Wealth Fund (NWF) on a retrofit funding scheme backed by £150m of guarantees from the Treasury-backed institution previously known as the UK Infrastructure Bank. Social Housing understands this is expected to launch early in the new year, and will support an initial £300m of funding in two tranches, one of secured, unguaranteed funding for general purposes and one of unsecured, guaranteed funding (for retrofit).

In addition, the acquisition of specialist consultancy Hargreaves Risk and Strategy, announced in September, is intended to grow THFC’s network and service offering.

Legacy

These approaches all build on what Ms Nair refers to as the key tenets of the organisation’s legacy, starting with its status as a mutual lender (reinvesting its surpluses) and being “adjacent to government”.

“That gives us a unique voice, and also gives us the trust of the sector,” the chief executive says.

Next comes THFC’s ability to continue to facilitate private capital from institutional investors to access the sector. “To that end, we’ve evolved our platforms with various financing vehicles. We want to continue to offer that, because investors want to continue to support the sector.”

Ms Nair still sees bank and bond financing as essential, and THFC will continue to deliver the secured financing it is “very good at”. However, the company will now start to build out its wider offer, too.

“The intention is to leverage the legacy of those tenets, still focused on the purpose mission, which is to provide financial solutions to housing associations (HAs) to achieve their objectives.

“We’ve just expanded that purpose a little bit to reflect the fact that we want to look at financial solutions, not just medium/long-term financing.”

Alongside its existing borrower base, THFC will now look to work more broadly within “sustainable communities”. It previously said this could include councils.

“There are many more participants and many more actors looking to deliver a similar mission and challenge,” Ms Nair tells Social Housing. “To that end, innovation is at the core, [so it’s about] what are those financial solutions? I think it’s just the evolution and maturity of the sector.”

Infrastructure

Asked what these financial solutions might entail, Ms Nair returns to her background in infrastructure – and adds her voice to growing calls for housing to be labelled as such.

“Look at what other sectors within infrastructure – whether it’s energy, utilities, transport – have used as solutions and tools to achieve their objectives,” she says.

Pointing to the approaches taken by utilities such as oil and gas in the energy transition, she says: “A lot of them finance projects through project financing off balance sheet, or they separate it out so that when they’re developing a project or a plant, [the approach is] different to when it’s completed and operating.

“There’s definitely a pocket of capital that likes development risk, because that’s what they look for; they like the risk reward. So can HAs, for example, access that, which means they need to separate out their perception of the different parts of the life cycle,” Ms Nair posits.

To date, associations have tended to borrow via bank or bond for ‘general corporate purposes’, including through the £7.95bn of loans THFC has facilitated.

“Maybe we need to be a bit more creative, that instead of just one pot being deployed for everything, being a bit more sensible about how different parts of what your priorities are or your objectives are or your needs are gets financed in a different way,” Ms Nair suggests.

Outcomes focus

A key issue these solutions will need to address is the much-cited challenge that, unlike new development, improvements to existing homes do not tend to yield a financial return on investment.

“Obviously you get an outcome with better homes, which is ultimately where we want to get to, but from a financial outcome, it’s trickier to see,” Ms Nair says.

She sees two potential avenues: “One is you find investors who are very much driven by that agenda, ie they’re looking for outcomes such as you’re satisfying fire and safety guidelines.”

The other is to “cheapen the cost”. This approach is reflected in THFC’s partnership with the NWF, where the guarantee will lower the cost of debt capital markets borrowing.

Asked whether there is also potential for carbon credits to play a role in THFC’s future solutions, Ms Nair acknowledges it is looking at how this works in other infrastructure sectors. “Could that be something where the financing is brought in and you get that as an outcome, not just a financial return? Maybe.”

Ms Nair expects the NWF partnership to transact early in the new year, with conversations underway with borrowers to “create a pipeline” across the two £150m tranches.

What’s in a name?

Zooming out from specific solutions, why is there a need to formally label the sector as ‘infrastructure’, Social Housing asks.

“By elevating it, you’re recognising the scale of the problem. So it becomes even more strategic to not just the public sector, but the private sector as a whole – to see it as a sector that would drive economic growth, would drive net-zero ambitions, help with regional disparities, ensure social cohesion,” Ms Nair says.

“So there’s a mindset shift, because you’re looking at it as central and strategic, too. And we’ve seen the start of that with this government, where they’ve elevated it into a more mission-led view.”

Ms Nair also sees a link to impact investors, who are already attracted to the sector’s social purpose.

“It’s a question of: how do you now bring more private capital investors into it? What are the other things you need to do? It’s about how you frame this sector to try and access that. The second part of that is: what way can they access; what’s the solution, what is the product?”

Again, the chief executive points to progress in energy transition.

“Look at the groundswell and capital that’s been amassed… It’s been phenomenal. It’s because it’s been elevated to be much more strategic, much more crucial to a lot of other aspects to our future state. As a consequence, if you talk to a lot of institutional investors, they’ve bought into that.

“How they participate can vary tremendously – and those are the solutions I talk about. But by elevating, you’re casting the net wider on the private-sector side.”

Potential solutions could include project-based financing or alternative ownership structures, Ms Nair suggests, “whether it’s equity or even quasi-equity”, and more use of public sector tools like guarantees and “other types of contingent liabilities”.

“None of this is without challenges,” she emphasises. “It’s a mindset shift, too, and it’s also a mindset shift around risk, people’s perception of risk. So it’s taking those steps to understand and educate that there are other solutions out there beyond what has been used thus far.”

Risk focus

This evolution in outlook is reflected in a strengthened team for THFC, not least with the acquisition of Hargreaves Risk and Strategy, a specialist consultancy focused on the housing sector, in particular small and medium-sized groups.

A new chief risk and operations officer, Martin Fent, will bring expertise from previous roles at funders including Cynergy Bank and RBS International when he joins THFC in January.

The addition of Ben Rick as chief finance officer also speaks to THFC’s intention to strengthen its offering to smaller organisations, which Ms Nair sees as its core product going forward. Most recently, Mr Rick was a senior advisor at Lloyds Bank and previously co-founded fund manager Social and Sustainable Capital. At both, he focused on increasing lending to smaller providers of social and supported housing.

Ms Nair refers to the company’s original premise as an aggregator – bringing efficiency, confidence and a route to market to the small and medium-sized provider.

“We want to continue to do that and understand what that sector needs.”

However, the aggregator will not cut ties with larger associations. “Because of our status as a mutual, where we reinvest all our surpluses, as well as us being adjacent to government, we have a unique position to partner with everyone, because we’re not competing in the same manner. We have much more of a long-term view.”

Ms Nair stresses the continued importance of THFC’s “regionally diverse” borrower base, with more than 150 spread across England, Northern Ireland, Scotland and Wales.

For-profits

Where for-profits are concerned, Ms Nair says the funder is “open to partnering with people who have similar values, purpose and have alignment”.

“I think that’s critical for the sector as a whole, especially as we talk about alternative financing structures,” she adds.

The new direction marks a significant departure, after nearly four decades, from the group’s commitment to the not-for-profit sector, so Social Housing asks whether there is a risk to how investors perceive the aggregator.

THFC will be “very careful there’s no cross-contamination”, whether that’s through governance or messaging around how it operates, Ms Nair says, while emphasising the continued importance of its core business (HAs).

Asked whether THFC would further extend its offering to include house builders, Ms Nair says “likely not, because that, I think, is well served. They can be a partner in a solution, for sure, but probably not our core product.”

Active engagement

With its new strategy launched, THFC is engaging with borrowers and stakeholders both around market access through its core product and exploring new financial solutions. It will be supported by a newly bolstered credit rating, after S&P upgraded THFC Group to A+ (stable) in September.

“It was nice to hear affirmation for our model and for what we’re trying to do,” Ms Nair says. Blend maintains its A2 (stable) rating from Moody’s.

Within the broader landscape, Ms Nair is also hopeful. Speaking to Social Housing a week after the Budget, she says: “I’m generally an optimistic individual, largely because I’ve worked through cycles.

“I think there definitely was a renewed sense of optimism with the change of government; communication channels seem to be more open for the sector. There’s definitely a focus on the long term, particularly on housing.”

While noting more clarity will need to come out of the spring statement, Ms Nair sees a key role for THFC at a time when public finances remain constrained, in both working with government and leveraging private capital.

“That’s very much what I call our nexus,” she says. “So it’s validating our view and our legacy, which is: how do you bring the two sectors to achieve the same goal?”

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED