THFC targets for-profits as part of new strategy

The Housing Finance Corporation (THFC) is looking to expand its offering to the for-profit sector and is working with the government’s UK Infrastructure Bank (UKIB) to help landlords fund retrofit projects.

The London-based aggregator, whose new boss joined in March, is hoping to arrange funding deals for the fast-expanding for-profit sector as part of a new corporate strategy.

The group also wants to widen the finance options for traditional housing associations, which remains its core business.

It comes as official figures published last week showed that cash reserves among the sector’s 200 biggest landlords, including for-profits, have fallen to a 10-year low.

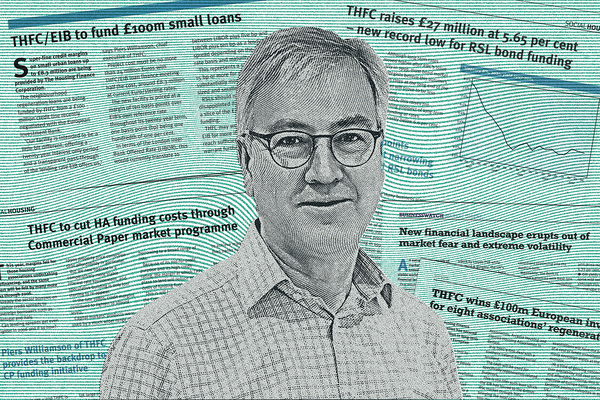

Priya Nair, chief executive of THFC, who replaced the long-serving Piers Williamson, said that housing providers’ mandates are “more complex than ever before and borrowing capacity remains constrained”.

She added: “To address this, our new strategy is focused on forging more partnerships, introducing a diverse range of financial solutions and expanding our product offering to all affordable housing-focused stakeholders – these include for-profit registered providers and adjacent related sectors.”

The other sectors could include councils, THFC said.

Ms Nair was previously a non-executive director at BlackRock-backed for-profit Heylo between June 2020 and February 2024.

The aggregator said it wants to find “appropriate routes” into the sector for “equity capital” and “solutions that avoid putting pressure on interest cover and balance sheets”.

G15 landlord Hyde is among those that have secured investment from outside the sector. Social Housing exclusively revealed in 2022 that insurance giant AXA had taken a joint stake in its for-profit Halesworth.

THFC also confirmed that it is continuing to work on a partnership with UKIB to launch a new financial debt guarantee. It is aimed at giving landlords access to “competitive unsecured funding for retrofit projects”, THFC said.

Social Housing first reported in March that UKIB was working with the aggregator and other lenders to create products that would involve a guarantee from the government-backed bank on a large proportion of the debt.

UKIB is wholly owned and backed by the Treasury but is operationally independent, and has around £22bn of finance to tackle climate change and support regional and local economic growth.

The broadening of THFC’s operations come as it is also undergoing an executive shake-up.

Last month Social Housing revealed that two of THFC’s senior directors were stepping down.

Meanwhile, a spokesperson confirmed that the aggregator is currently recruiting to grow its top team.

In its last full year to the end of March 2024, THFC reported a 23 per cent rise in post-tax surplus to £5.9m off an opening income of £291.7m. The group currently has a loan book of nearly £8bn.

THFC’s board of directors include former L&Q boss David Montague and Fiona MacGregor, chief executive of the Regulator of Social Housing.

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED